Denis Cook

February 11, 2026

Companies that have generated or purchased transferable clean energy tax credits

Participation in the tax credit market – whether a company buys, sells, or reatain credits – has been broad and deep.

For Buyers

For Sellers

Companies that have disclosed buying, selling, or retaining transferable clean energy tax credits under the Inflation Reduction Act (IRA)

Katherine Westcott

February 5, 2026

Footnote of the Week: Among Insured Tax Credit Deals, Many Have Coverage Levels of 110% or Higher

For transactions that include insurance, our data reveals that the Limit of Liability often exceeds the face value of the tax credit.

For Buyers

For Sellers

In discussions of energy tax credit transfers, much of the focus goes to headline numbers like pricing, deal sizes, and types of credits. A less discussed element that can make or break a deal is tax credit insurance. The demand for tax credit insurance, which is designed to protect the value of tax credits in the event of an IRS challenge, has grown significantly since the start of transferability.

Since Reunion began facilitating tax credit transfers in 2023, about 40 percent of our transactions have included tax credit insurance coverage. As shown in the colored bars below, most of this insurance coverage has had a Limit of Liability equal to or greater than 100%. Conversely, the black bar represents the roughly 60 percent of deals that did not include insurance, suggesting cases in which the tax credit seller could provide a sufficiently strong indemnification, or the parties were comfortable with the risk-reward of the credits being transferred.

The pattern of Limits of Liability commonly exceeding 100% is noteworthy, and implies that many tax credit buyers want protection from second-order risks such as penalties and legal fees that could arise from a disallowance or recapture. To gauge the upper range of these Limits of Liability, we dug into the tax credit type that we’ve seen insured most frequently: §48 investment tax credits.

For §48 transfers, the Limits of Liability have pushed markedly higher than face value – with a little over half of insured deals hitting 110% or higher, and multiple deals establishing Limits of Liability greater than 130%. (The small share of deals with a liability limit below 100% are primarily distributed or residential energy assets; this coverage is designed to support a partial loss, rather than a less likely portfolio-wide loss event.)

While tax credit insurance isn’t warranted on every deal, it plays an important role in enabling tax credit transfers among risk-sensitive buyers, especially when the seller is not investment grade. Our analysis suggests that relatively high Limits of Liability are supported by the market, and may give buyers access to a wider range of tax credit opportunities.

Denis Cook

January 8, 2026

ASU 2023-09 should highlight adoption of IRA clean energy tax credits

ASU 2023-09, Improvements to Income Tax Disclosures, requires public and private companies to provide a more detailed tax rate reconciliation in their financial statements. Participation in the transferable clean energy tax credit market should become more clear.

For Buyers

For Sellers

Overview of ASU 2023-09

Accounting Standards Update (ASU) 2023-09, Improvements to Income Tax Disclosures, represents the FASB’s latest effort to modernize and enhance income tax disclosures under ASC 740, with a clear emphasis on improving transparency around effective tax rate drivers and cash taxes paid.

For corporate tax professionals, the update is less about changing tax accounting and more about significantly expanding what must be explained – and supported – in the tax footnote.

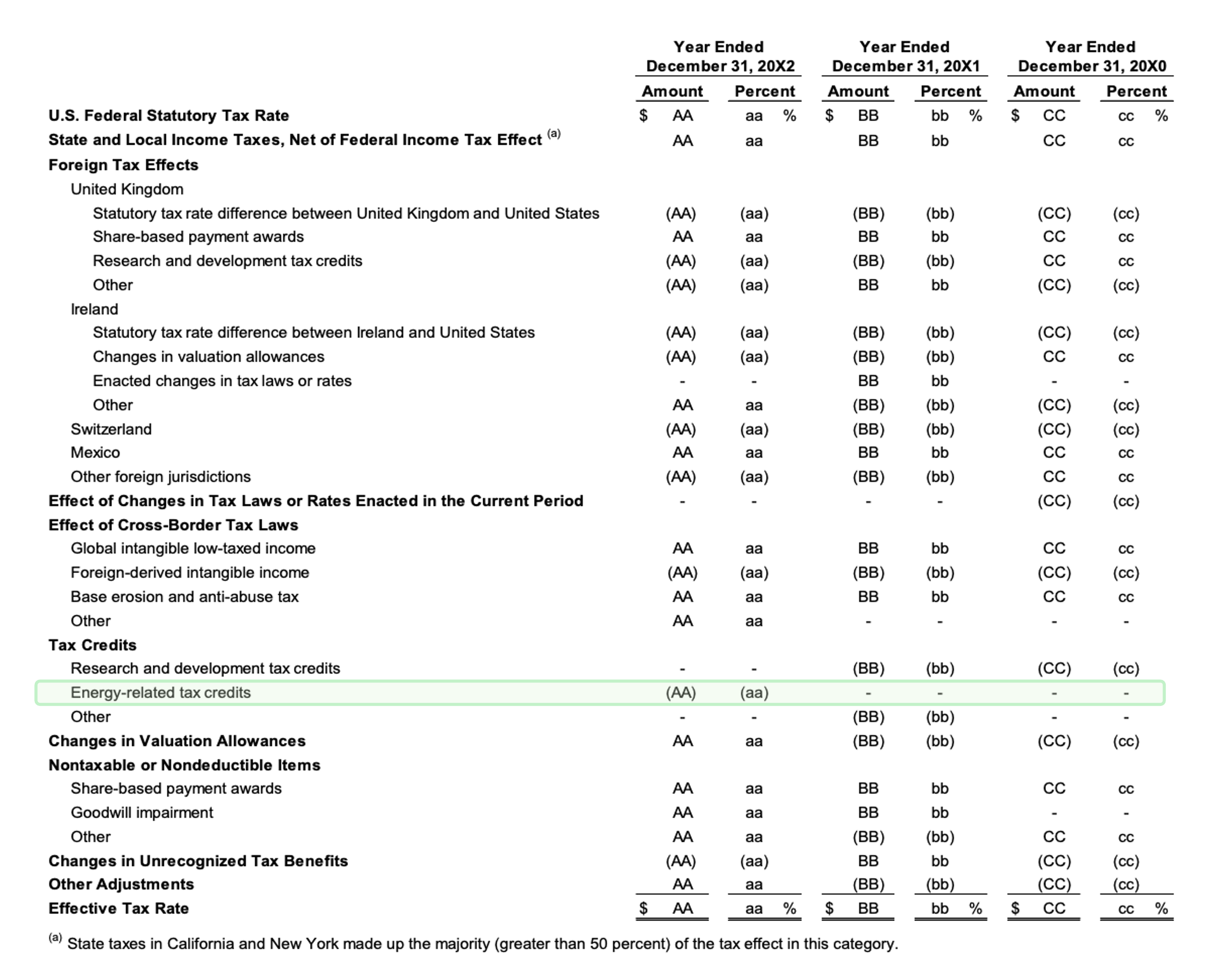

At its core, 2023-09 requires companies, public and private, to provide a more robust and structured explanation of why their effective tax rate differs from the statutory federal rate. The rate reconciliation must now be presented in a tabular format that includes both dollar amounts and percentages, and reconciling items must be categorized using prescribed groupings such as state and local taxes, foreign tax effects, tax credits, valuation allowance changes, and changes in tax laws.

When reconciling items exceed a quantitative threshold – generally 5.0% of the tax at the statutory rate – further disaggregation is required, often by nature or jurisdiction. The result is a more decision-useful, but also more data-intensive, reconciliation.

When do the disclosure updates go into effect?

ASU 2023-09 applies to public business entities (PBEs) and non-PBEs. Simplistically, a PBE is a public company, while a non-PBE is a private company.

The new requirements within ASU 2023-09 go into effect at different dates, depending on the type of entity:

- PBEs: Annual periods beginning after December 15, 2024 – generally, calendar year 2025

- Non-PBEs: Annual periods beginning after December 15, 2025 – generally, calendar year 2026

Impacts on transferable tax credit investments

ASU 2023-09 does not change the accounting for transferable tax credits, but it will make their financial statement impact more visible through enhanced income tax disclosures.

Most notably, tax credits that materially reduce tax expense will need to be more clearly reflected in the effective tax rate reconciliation. Under the new standardized categories and quantitative thresholds, significant transferable credits are likely to be disclosed as a separate reconciling item rather than being aggregated within broader “credits” or “other” categories, increasing transparency around their role in lowering the effective tax rate.

The new income taxes paid disclosure also affects companies that utilize transferable credits. Because these credits often reduce cash taxes owed, companies may report low or minimal taxes paid in certain jurisdictions. ASU 2023-09 requires income taxes paid, net of refunds, to be disaggregated by federal, state, and foreign jurisdictions, with separate disclosure for significant jurisdictions, making the disconnect between tax expense and cash taxes paid more apparent.

Finally, while the ASU is disclosure-focused, it may drive additional documentation and controls around transferable credits. Companies should expect greater scrutiny of the nature, materiality, and sustainability of tax credit investments, as well as more robust explanations in the tax footnote regarding how those credits affect both the effective tax rate and cash tax profile.

Sample income tax disclosure

ASU 2023-09 includes a “sample rate reconciliation between income tax expense (or benefit) and statutory expectations.”

Which companies that have bought or generated transferable clean energy tax credits?

Reunion maintains a running list of companies that have bought or generated transferable clean energy tax credits.

Denis Cook

December 10, 2025

Reunion's Q3 2025 Transferable Tax Credit Pricing and Markets Update

Reunion’s Q3 Market Monitor print highlights moderate tax credit pricing declines, but continued market maturation

For Buyers

For Sellers

Reunion recently released our Q3 Market Monitor update, including forward-looking pricing estimates through Q4 of this year.

Overall, our data highlights two seemingly divergent trends: (1) softened demand for 2025 tax credits alongside (2) increased market maturity and liquidity.

To better understand this dynamic, this note examines six key trends from our data:

- Pricing: 2025 tax credit prices have declined compared to 2024 levels, primarily due to the OBBBA

- Market dynamics: Sections 45U and 45Z are becoming increasingly popular production credits

- Transaction timing: 10% of 2024 tax credit transfers closed in Q3 2025

- Prevailing wage and apprenticeship (“PWA”): Credits that are PWA exempt because of beginning of construction (“BoC”) exemption are vanishingly rare

- FEOC: FEOC will become a key purchase consideration, with upward pricing for credits with low FEOC risk

- Credit adders: Adoption of bonus credit adders continues to expand for ITCs, but remains muted for PTCs

Pricing

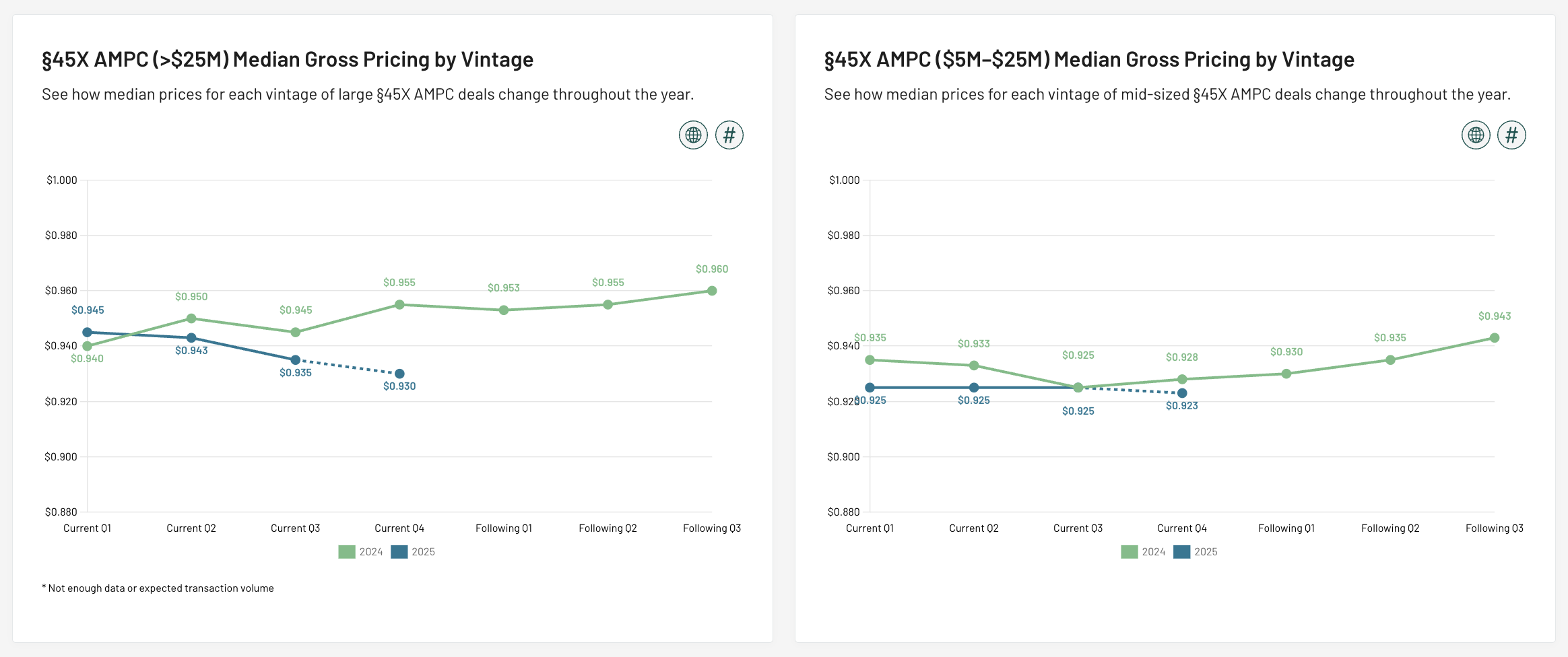

2025 tax credit prices have declined compared to 2024 levels

Across virtually all credit types and deal sizes, 2025 pricing declined relative to 2024 levels. This trend has been particularly pronounced in Q3 and Q4. In 2024, prices rose from Q3 to Q4 as buyers competed for increasingly limited supply. In 2025, the trend reversed, with pricing generally softening over the same period.

Investment-grade (“IG”) supply continues to command a premium – ITCs from IG sellers, for example, continued to trade one to three cents above these median levels in late 2025.

*Section 48 ITC pricing is exclusive of residential solar and biogas. Reunion maintains separate pricing series for these technologies.

The following chart compares estimated Q4 2025 to actual Q4 2024 data. This year’s Q4 data is based on deals closed through November and terms sheets executed through the publication date of this note.

*Section 48 ITC pricing is exclusive of residential solar and biogas. Reunion maintains separate pricing series for these technologies.

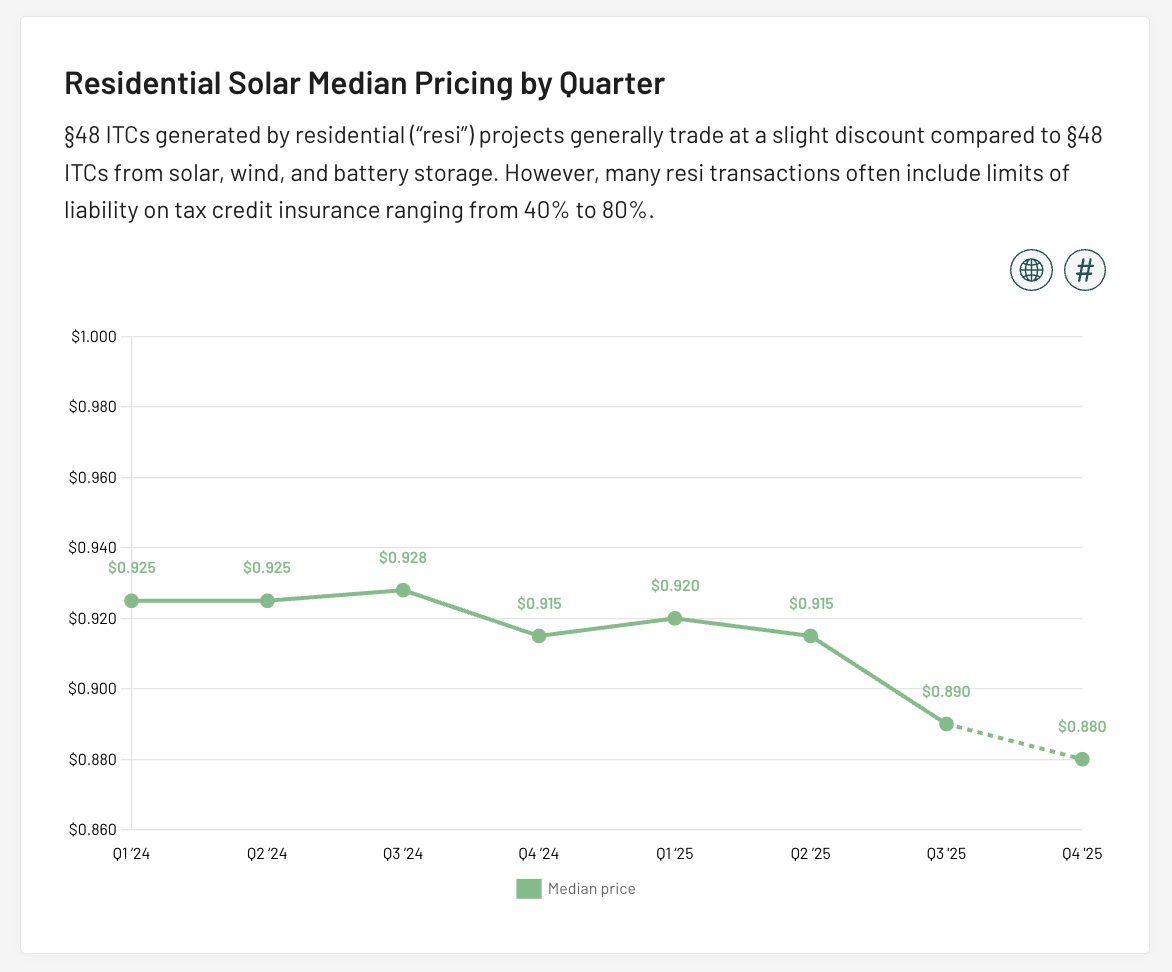

Residential, or “resi,” solar experienced marked price declines throughout 2025 as well. (Reunion maintains separate pricing series for ITCs from resi solar and biogas. We do not include resi and biogas deals in our market-wide Section 48 ITC pricing above.) Looking across 2024 and 2025 vintages, median prices fell from $0.928 in Q3 2024 to an estimated $0.88 in Q4 2025.

When understanding resi prices, it's important to recall that buyers and sellers often negotiate the limit of liability ("LOL") on resi tax credit insurance policies, which flows through to headline pricing. A major resi solar developer, for example, offered a further discount of two cents for an LOL of 40% versus 100%.

While “headline” declines in prices have been modest on a percentage basis, the flow through to cash tax savings has been significant

A corporate taxpayer who purchased a $50M tranche of Section 48 ITCs Q3 2024 and am equivalent $50M tranche of Section 48 ITCs in Q3 2025 would have benefited from an additional $500,000 in cash tax savings – a 14.3% increase.

Tax credit pricing declines in 2025 have largely been driven by impacts of the OBBBA

In the months leading up to the Bill’s passage on July 4, the tax credit market slowed as buyers hesitated to make meaningful commitments without clarity on the final legislation. Many feared that 2025 tax credits might be retroactively repealed and chose to wait for assurance that existing credits would be respected before proceeding with transactions.

The Bill provided clarity that both current- and future-year tax credits will be respected, but the OBBBA itself had a significant downward impact on corporate tax liabilities. Dozens of corporations that were expecting $50M or $100M+ in tax liability no longer had the appetite to purchase 2025 credits.

Today, many companies are still working to understand how OBBBA will affect their final 2025 tax liability – and have delayed purchasing credits as a result.

We expect lingering OBBBA-related impacts on 2026 tax liabilities. As of the publication of this note, Reunion is conducting our year-end tax credit buyer survey, and early feedback suggests that corporations are anticipating reduced 2026 tax liabilities of 10% to 30% against an assumed “non-OBBBA” baseline. Varying degrees of impact tend to cluster in sectors that are particularly sensitive to tax law changes. We’ll publish our year-end buyer report in early 2026.

Although 2026 aggregate demand may be down compared to this non-OBBBA baseline, we are seeing a significant number of taxpayers moving early on 2026 credits. These taxpayers generally fall into two camps:

- Strategic: Companies proactively seeking investments over $50M

- Opportunistic: Companies seeking investments with outsized discounts

We will incorporate pricing for 2026 tax credits in our Q1 2026 Market Monitor release.

Market dynamics

Section 45U nuclear and Section 45Z clean fuels are becoming increasingly popular production credits

In the second half of 2024, a handful of Reunion’s corporate clients explicitly prioritized Section 45U zero-emission nuclear power production credits (“ZENPPCs”). However, the majority of production credit-focused buyers focused on Section 45 PTCs.

As we approach the end of 2025, we have observed that many production credit-focused companies now view 45U ZENPPCs and 45 PTCs with roughly equivalent interest. From a pricing perspective, 45U nuclear credits are among the most stable.

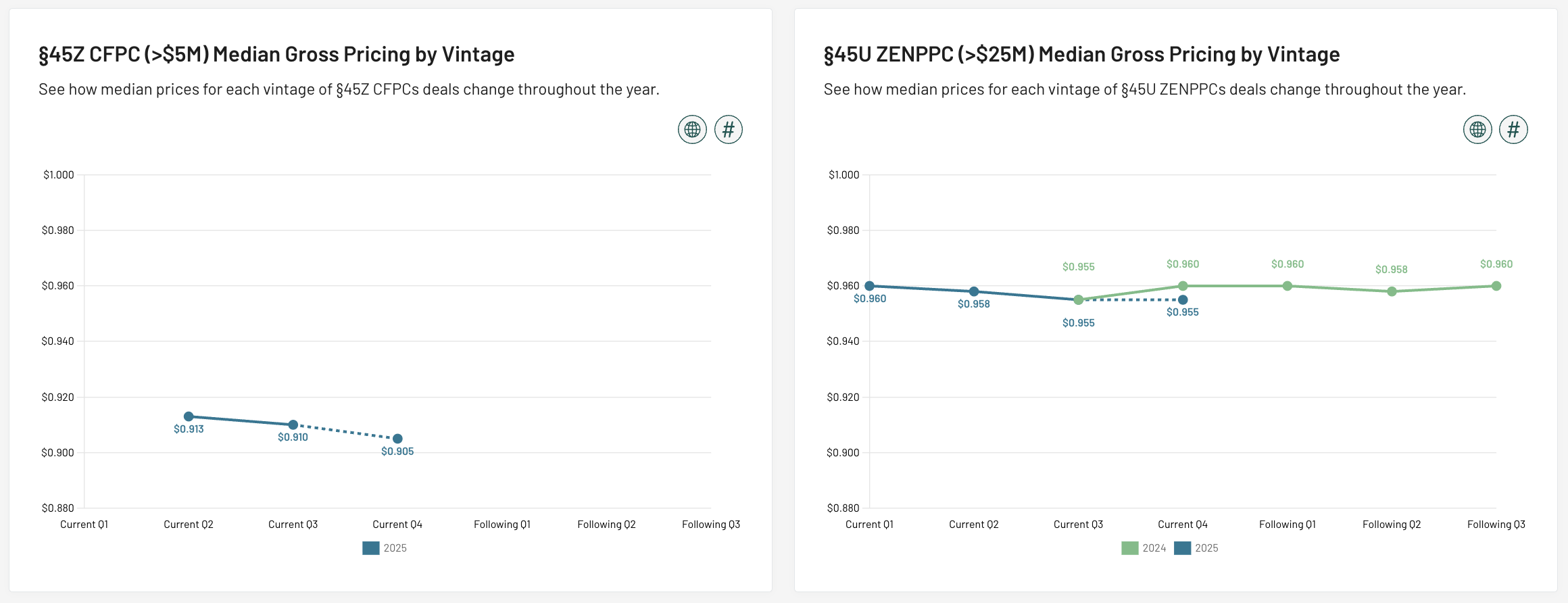

A similar pattern is emerging around Section 45Z clean fuel production credits (“CFPCs”). An increasing number of corporate buyers are actively targeting 45Z credits due to two key factors:

- Risk/return: Section 45Z clean fuel credits are trading in the high $0.80s to low $0.90s, depending largely on the purchase size, presence of tax credit insurance, and the seller’s financial strength. Although this pricing generally aligns with Section 48 ITCs, Section 45Z CFPCs are not subject to recapture.

- General business credit (“GBC”) ordering: Tax credit carrybacks have become more popular, and an effective carryback strategy must account for the credit-ordering rules reflected in IRS Form 3800. Compared to Section 48 ITCs, Section 45Z CFPCs are more advantageous for a carryback from a credit ordering perspective.

To reflect this growing interest, we are now publishing pricing series for both 45U and 45Z credits. Our 45U pricing goes back to 2024, while 45Z begins in 2025 (when the credit first became available).

Although demand for 45Z credits is growing, prices have moderated slightly throughout 2025. We believe this reflects supply dynamics: since the 45Z credit only became available this year, a preponderance of sellers entered the market in the latter half of this year, generally offering full-year tranches of 2025 credits.

Looking ahead to 2026, we expect, and have already begun to see, 45Z deals structured around quarterly payments, akin to many Section 45 PTC transactions. Strips should become increasingly common, too.

The Treasury and the IRS have not yet issued final guidance for either of these credits, though this has not been a gating factor for most buyers. 45Z, in fact, is among the credits that received favorable treatment under the OBBBA.

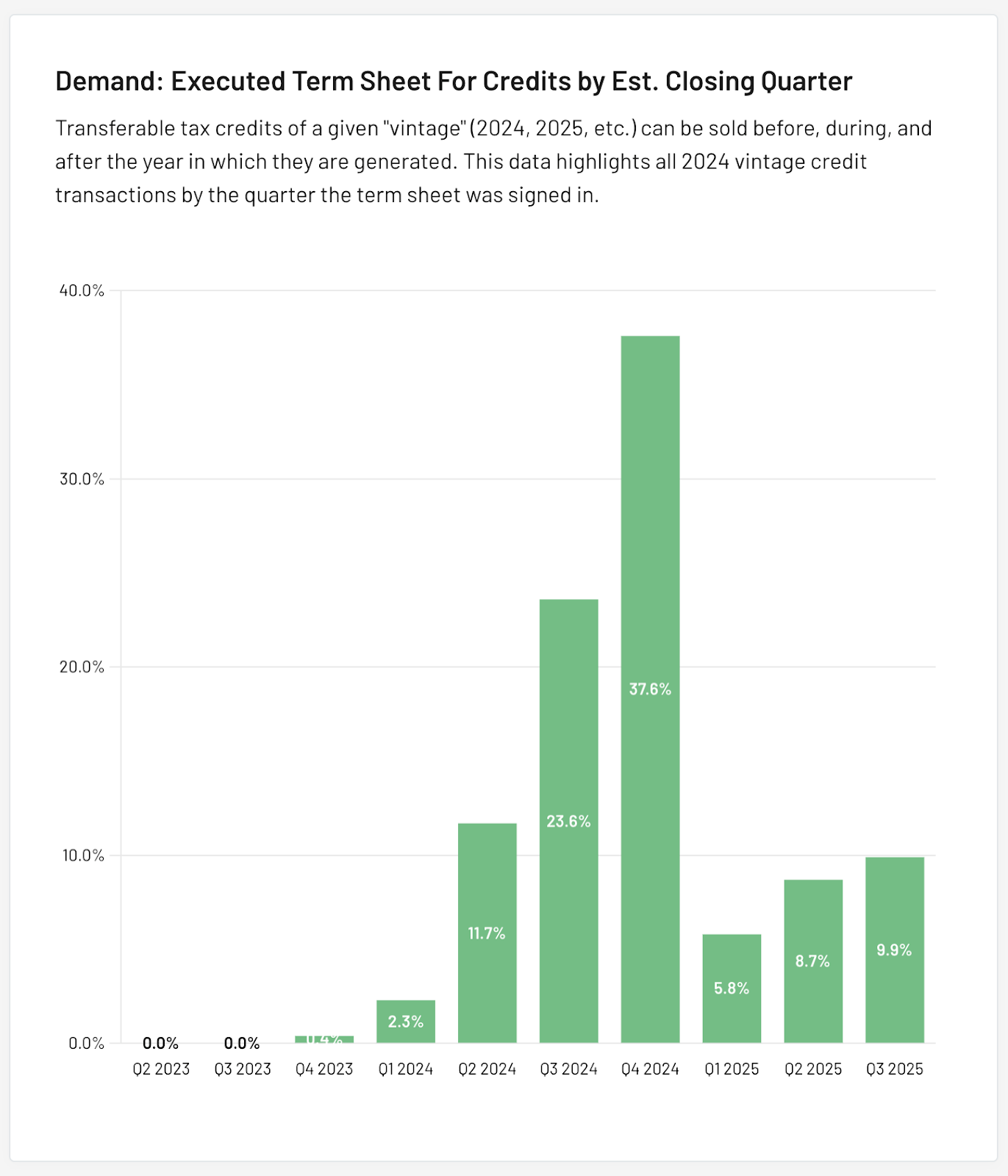

10% of 2024 tax credit transfers closed in Q3 2025

Nearly 10% of all transfers involving 2024 credits took place in Q3 2025 – concentrated heavily in September and the first half of October, just ahead of the extended filing deadlines for both partnerships and C-corporations, respectively. This is measured by notional deal volume.

For many buyers, these “before-the-buzzer” transactions were structured around a carryback strategy, allowing them to request a refund simultaneously with the filing of their 2024 return.

Other deals were driven by the desire to fully utilize remaining tax capacity under the 75% statutory credit offset cap.

Regardless of the buyer’s underlying motivation, sellers generally benefited from premium pricing. Section 45X transactions for the 2024 vintage, for example, traded at the top of their range in Q3 2025 – "Following Q3" for the 2024 trend line – for both large and small deals.

PWA

Credits that are PWA exempt because of beginning of construction (BoC) dates are vanishingly rare

In the early days of the transfer market, buyers often sought tax credits that were exempt from prevailing wage and apprenticeship (PWA) requirements in an effort to avoid an incremental due diligence burden. Projects that either began construction before January 29, 2023 or have a capacity of less than 1 megawatt are generally exempt from PWA rules.

In 2023, nearly all available credits on Reunion’s platform fit that profile: by credit value, 95% of Section 48 ITCs and 100% of Section 45 PTCs were PWA-exempt due to BoC timing. Fast-forward to the 2026 credit vintage, and the landscape has essentially reversed.

Projects with a capacity under 1 MW, such as residential solar, remain exempt from PWA requirements, as do certain other credit types (e.g., 45X credits).

Only 1% of 2026 Section 48 ITCs and 29% of Section 45 PTCs remain PWA-exempt due to BoC timing.

The 29% exemption figure for 2026 Section 45 PTCs may give buyers an overly optimistic impression. Much of this volume is already committed through multi-year strips or tied up by existing buyers holding rights of first refusal. As a result, PWA-exempt PTCs that are broadly available may carry a pricing premium and clear the market quickly.

FEOC

FEOC is becoming a key purchase consideration, resulting in premium pricing for credits with low FEOC risk

In 2024, buyers specifically requested credits that were exempt from PWA requirements. We are starting to see a similar trend emerging with respect to Foreign Entity of Concern (FEOC); buyers are prioritizing “legacy” Section 48 ITCs and Section 45 PTCs that qualify as FEOC-exempt. We expect legacy credits to trade at a premium price compared to similar credits (e.g., 48E and 45Y) that require compliance with FEOC rules.

We expect demand for increasingly scarce "legacy,” FEOC-exempt Section 48 and Section 45 tax credits to drive pricing higher.

Credit adders

Adoption of bonus credit adders continues to expand for ITCs, but remains muted for PTCs

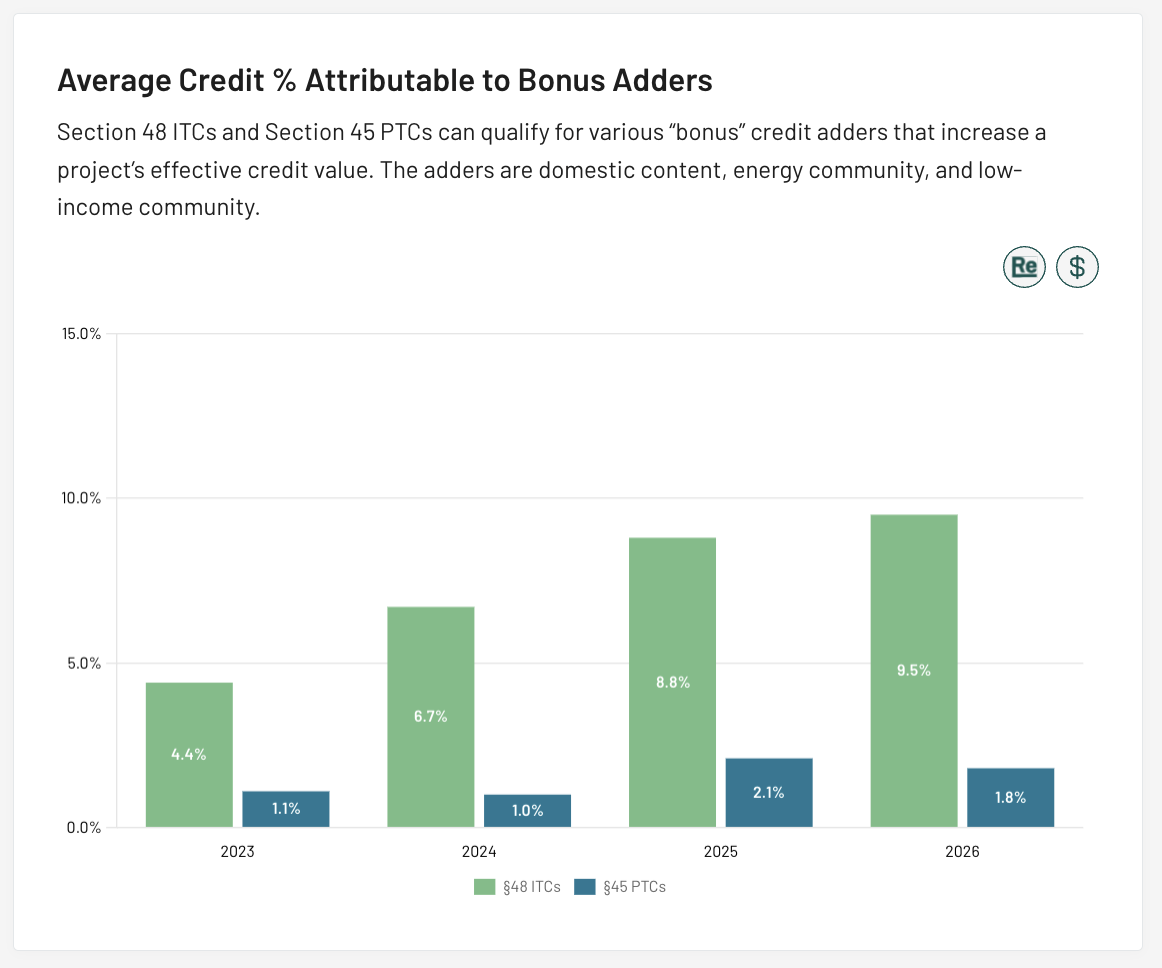

Section 48 ITCs and Section 45 PTCs can qualify for various “bonus” credit adders that increase a project’s effective credit value.

Since 2023, average ITC credit amount above the 30% baseline (assuming PWA compliance), have risen from 4.4% to 9.5%, indicating that most developers are now effectively incorporating at least one credit adder.

From a buyer’s perspective, Section 48-eligible projects without a bonus credit adder have become relatively scarce.

Section 45 PTCs, by contrast, show a different pattern. Average PTC rates above the base credit amount have remained relatively flat from 1.1% in 2023 to 1.8% in 2026. This stability is expected, however, because many Section 45 PTCs originate from projects that pre-date the Inflation Reduction Act’s introduction of bonus credit adders.

Access Reunion's Q3 Update to Market Monitor

Explore the latest pricing trends, transaction data, and market dynamics shaping the transferable tax credit market.

Mahon Walsh

December 5, 2025

A guide to quick refunds for tax credit buyers

Form 4466 quick refunds help tax credit buyers recoup their investment months sooner

For Buyers

In brief

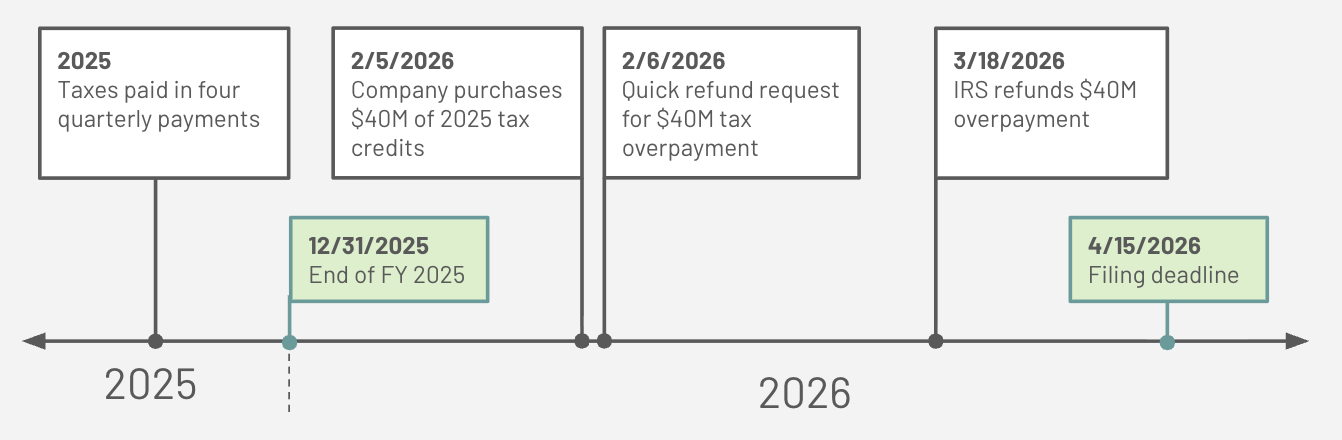

A quick refund under IRC §6425 allows a corporation that has overpaid its estimated income taxes – perhaps due to buying tax credits – to get cash back before filing its full tax return. By filing IRS Form 4466 shortly after year-end (and before the regular return due date), eligible corporations can recover overpayments – so long as the excess exceeds both $500 and 10% of expected tax liability. For tax credit buyers in particular, quick refunds are a powerful cashflow tool, accelerating the economic benefit of credits by months compared to the standard refund process.

Quick refunds allow corporations to recover overpaid estimated taxes early

Under IRC §6425, a “quick refund” allows a corporation that has overpaid its estimated federal income tax to request an “adjustment” of its estimated income tax prior to filing its full annual return.

Corporations may request a quick refund by filing IRS Form 4466 (see the full Instructions for Form 4466).

Quick refunds have become a common mechanism for corporations purchasing tax credits to more quickly realize the benefit of their investment in the event that they overpaid their estimated tax.

Quick refunds accelerate cash recovery from tax credit purchases

If a corporation has overpaid estimated tax due to a tax credit transaction in their current tax year, the quick refund returns the overpayment much faster than the conventional refund process. This allows the corporation to more quickly realize the benefit of their investment.

Benefits are particularly pronounced for corporations who purchase credits in the months immediately preceding or following the close of their tax year. As a quick refund can only be requested after the end of a given tax year (see §6425(a)(1)), corporations purchasing tax credits in the months surrounding the end of their tax year may more quickly request and receive a quick refund.

A quick refund, however, yields benefits for any corporation that has overpaid their estimated tax, regardless of the timing of their tax credit purchase.

Eligibility depends on the size of the estimated tax overpayment

Corporations that have overpaid their estimated income tax in the current tax year are eligible for a quick refund under Form 4466. Take a company that has an estimated 2025 tax liability of $100M, which it pays in quarterly estimated tax payments of $25M each. Let’s assume that the company purchases $40M of tax credits, reducing their estimated tax liability to $60M.

- After their Q3 estimated payment date, they will have paid $75M in estimated taxes, which is an overpayment of $15M

- After their Q4 estimated payment date, they will have paid $100M in estimated taxes, which is an overpayment of $40M

If the corporation is in an overpayment position, they can file for a quick refund using Form 4466. To qualify, the overpayment must be:

- Greater than 10% of expected tax liability for the year AND

- Greater than $500

Form 4466 must be filed shortly after year-end

Corporations must apply for a quick refund after the end of their tax year (e.g., December 31 for calendar-year tax filers) but before the 15th day of the fourth month thereafter and their income tax return filing (Form 1120) for that year. Thus, a calendar-year filer would submit Form 4466 between January 1st and April 15th.

Form 4466 instructions state, “An extension of time to file the corporation’s tax return will not extend the time for filing Form 4466”, so corporations must file Form 4466 before their non-extended tax filing deadline, even if they extend. In other words, a corporation with a December year-end that extends their tax return filing date must still submit Form 4466 before April 15th. Practically speaking, corporations should file a quick refund request as soon as possible after their tax year-end to maximize cashflow benefit.

The corporation must also file a copy of the previously filed Form 4466 with its income tax return.

Refunds are typically issued within 45 days

The IRS is required to process a Form 4466 request within 45 days. The IRS may review elements of the filing, so corporations should be prepared to provide any requested information promptly to avoid delays in receiving the refund.

Here is a sample quick refund timeline for a calendar-year filer with a filing deadline of 4/15/26:

- The company has a 2025 estimated tax liability of $100M, which it already paid in four quarterly payments of $25M

- The corporation purchases $40M of Section 48 ITCs on 2/5/2026 for $36M. The corporation has now overpaid their 2024 taxes by $40M.

- The corporation submits Form 4466 on 2/6/2026, requesting a quick refund of their $40M overpayment

- The corporation receives $40M from the IRS on 3/18/2026, realizing their cash savings of $4M

Alex Melehy

November 26, 2025

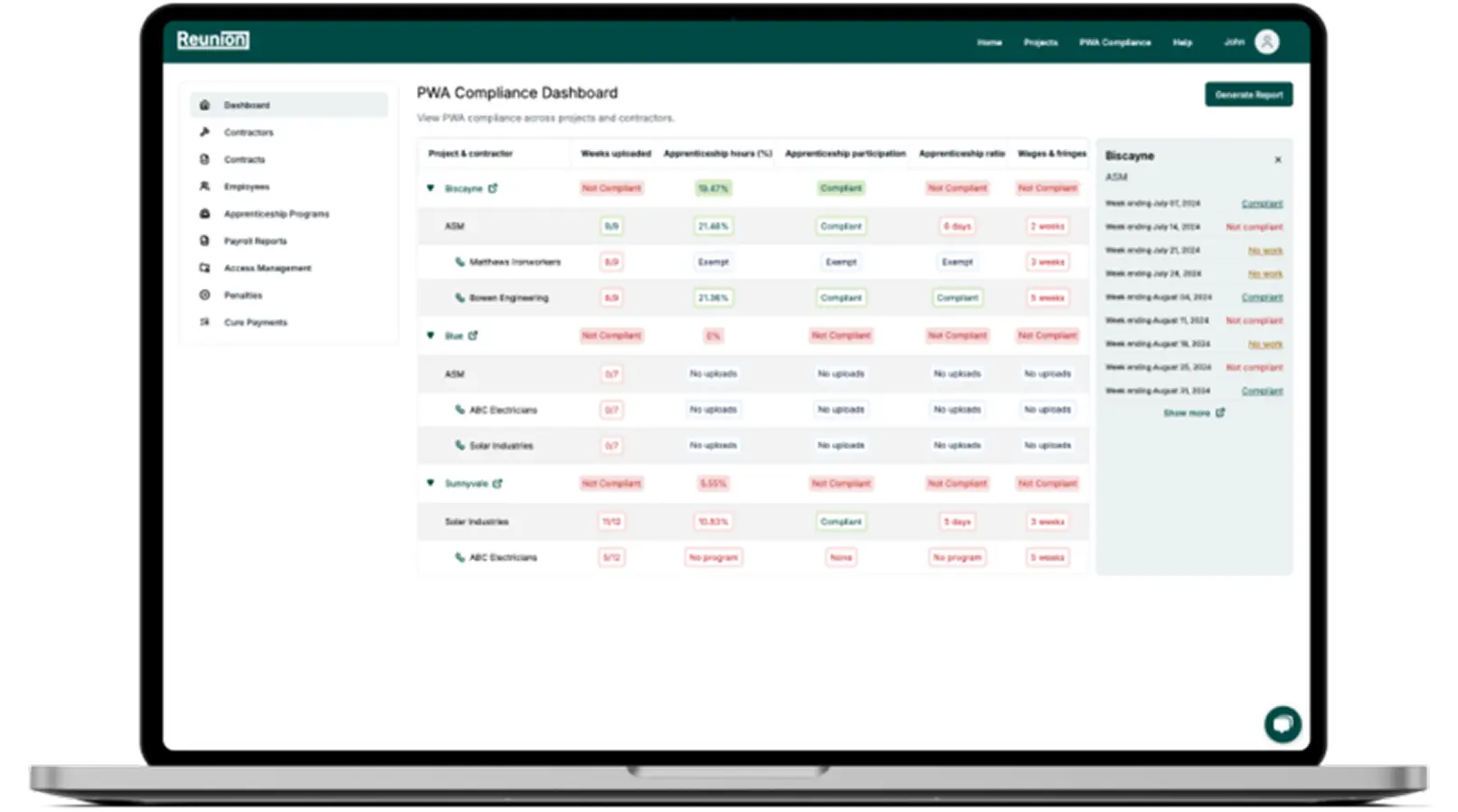

A Comprehensive Guide to Complying with Prevailing Wage and Apprenticeship Requirements

Ensure compliance with the final regulations on prevailing wage and apprenticeship requirements for energy tax credits. Mitigate risks & avoid penalties.

For Buyers

For Sellers

The Inflation Reduction Act (IRA) aims to create a robust market for well-paying clean energy jobs. To achieve this goal, the IRA significantly increases the tax benefits for projects that meet Prevailing Wage and Apprenticeship (PWA) requirements. The IRA introduced transferable tax credits, codified under §6418 of the Internal Revenue Code (IRC), allowing "eligible taxpayers" to sell certain energy tax credits to unrelated third parties for cash. Transferability intends to broaden the pool of investors participating in clean energy financing by simplifying complex structures like traditional tax equity arrangements.

Projects that comply with PWA requirements generally receive a tax credit that is five times greater than the base rate. Of the 12 tax credits eligible for transfer, only the §45X credit is not subject to PWA requirements.

The IRS and Treasury published final PWA regulations on June 18, 2024, which went into effect on August 26, 2024. Alongside the final regulations, the IRS published a fact sheet and updated its PWA FAQs.

For more information about Reunion’s PWA compliance product, please contact us here.

Prevailing wage rules

Overview of prevailing wage

Prevailing wage rules require that laborers and mechanics who are employed by the project developer, or by construction contractors or subcontractors working on the project, are paid a minimum prevailing wage specified by the U.S. Department of Labor (DOL). Prevailing wages must be paid during the construction of a facility or property, and during alteration or repair of a facility or property for a certain number of years after the project is placed in service (see Duration of PWA requirements section).

Prevailing wages apply not only to laborers and mechanics at the site of construction, but also to secondary sites where a significant portion of the construction, alteration, or repair of the facility occurs, provided that the secondary site either was established specifically for, or dedicated exclusively for a specific period of time to, the relevant project. Secondary sites include any adjacent or virtually adjacent dedicated support sites, such as job headquarters, tool yards, batch plants, or borrow pits.

Workers do not have to be paid prevailing wages for basic maintenance work, which is “routinely scheduled and continuous or recurring.” Examples of basic maintenance are regular inspections of the facility, regular cleaning and janitorial work, regular replacement of materials with limited lifespans such as filters and light bulbs, and the calibration of any equipment.

When to start paying prevailing wages

Prevailing wages must be paid from the time at which construction, alteration, or repair begins; the definition of construction, alteration, or repair is expansive and includes all types of work done on a particular building or work site, as defined in 29 CFR 5.2. This aligns with the Davis-Bacon Act (DBA) definition administered by the DOL, rather than the physical work and 5% tests the IRS has used to determine when construction starts for tax purposes (as discussed in the Beginning of construction section). For example, prevailing wages must be paid during certain demolition or removal activities, which would not be considered the start of physical work on the project for purposes of qualifying for tax benefits.

Determining the prevailing wage rate

Prevailing wage rates are published on the SAM website. The appropriate job type, location, and wage determination must be selected to comply with prevailing wage requirements. Occasionally, a job type for a given location will not be published. In this case, the taxpayer must contact the DOL at IRAprevailingwage@dol.gov to request a wage determination for the unlisted job type. The request to the DOL must include specific pieces of information such as form SF-1444, project name and location, contractor name, contract number (if applicable), name and description of the job classification needed, proposed wage rate and fringe benefits, the duties performed by workers in the proposed classification, explanation of why no current classification in the wage determination matches these duties, and an agreement or disagreement of the contracting officer and contractor with the proposed rate. The department has indicated that it will try to respond to wage determination requests within 30 days. For more information, please consult our PWA Help Center.

The prevailing wage rates that must be paid are locked in at the time the contract for the construction, alteration, or repair of the facility is executed by the project developer and the contractor. This is consistent with the timing of wage determinations in Davis-Bacon compliant projects. If a project developer enters into a contract for alteration or repair work over an indefinite period of time that is not tied to the completion of any specific work, the applicable prevailing wage rates must be updated on an annual basis on the anniversary date of such contract.

If the project developer executes separate contracts with more than one prime contractor, then for each such contract, the applicable prevailing wage rates are determined at the time the contract is executed with each prime contractor. The prevailing wage rates apply to all subcontractors under each prime contractor. Prevailing wage rates must be reset to current wage rates if the contract is later amended to add substantially to the scope of work or extend the contract period.

If work on a project straddles locations with different wage rates, then the project developer should pay the wages for each location based on where the work is done. Offshore wind projects should use the prevailing wages for the closest location on shore.

Reunion PWA automatically scrapes the SAM website for all wage determinations across all states and counties regularly. Reunion makes this data available and searchable via Reunion PWA so that developers and contractors can easily select the appropriate wage determinations for their projects.

Apprenticeship rules

The IRA’s apprenticeship rules fall into three main categories.

Labor hours requirement

The apprenticeship rules require a certain percentage of labor hours during construction, alteration, or repair for a project prior to the facility being placed in service to be performed by a qualified apprentice. The minimum percentage of hours that must be performed by qualified apprentices is:

- 12.5% for projects that began construction after December 31, 2022, and before January 1, 2024

- 15.0% for projects that begin construction after December 31, 2023

Hours worked by foremen, superintendents, owners, or persons employed in a bona fide executive, administrative, or professional capacity are excluded from the labor hours calculation, unless these persons devote more than 20% of their time during a workweek to manual or physical labor. In this case, the hours worked must be included in the denominator (total labor hours) of the apprentice labor hours calculation.

Ratio requirement

Any apprentices performing work on a project are subject to the applicable apprentice-to-journeyworker ratio as prescribed by the associated registered apprenticeship program. Apprentice-to-journeyworker ratios must be met daily and vary depending on the applicable apprentice program’s requirements.

Participation requirement

Any contractor, subcontractor, or taxpayer who employs four or more mechanics or laborers on the project must employ one or more qualified apprentices. The journeyworkers and apprentices, however, do not have to be employed at the same time, provided that the applicable apprentice-to-journeyworker ratio as prescribed by the associated apprenticeship program is met on days when the apprentice is working.

Duration of PWA requirements

The duration of the PWA compliance requirement depends on the tax credit type. The IRS clarified in the final regulations that apprentices are not required for work after a project is placed in service; therefore, compliance during the post-construction period applies only to prevailing wages.

As previously noted, §45X advanced manufacturing production credits are not subject to PWA requirements.

Impact of PWA Compliance on Tax Credits

Overview

The Prevailing Wage and Apprenticeship (PWA) requirements are a critical component of the Inflation Reduction Act of 2022 (IRA), and compliance with these rules has a direct and substantial financial impact on the value of most clean energy tax credits.

PWA compliance determines whether a project qualifies for an enhanced, significantly larger tax credit amount, which is generally five times greater than the base tax credit rate.

Financial Impact: The 5x Multiplier

For most transferable tax credits, meeting the PWA requirements results in a credit rate that is five times higher than the base rate.

The IRS updates §45 and §45Y PTC rates on an annual basis, generally in Q2. Rates are determined using an inflation adjustment factor (IAF) and published in the Federal Register. The inflation adjustment factor for 2025 is 1.9971. Specific examples of this financial enhancement include:

- Investment Tax Credits (§48 and §48E ITCs):

- If PWA requirements are met (or exempted from), the credit is 30% of a project’s qualified basis.

- If PWA requirements are not met, the credit is reduced to the base rate of 6% of the qualified basis.

- Furthermore, achieving PWA compliance is necessary to receive the full value of certain bonus credits. For example, the Energy Community bonus or Domestic Content bonus is typically 10% of the qualified basis if PWA requirements are met, but only 2% if they are not met.

- Production Tax Credits (§45 and §45Y PTCs):

- The §45Y PTC has one base rate, irrespective of when a qualifying project is placed in service. The base rate is $3 per megawatt-hour (MWh) of qualifying electricity produced and sold. With PWA compliance (or exemption), the rate increases to $15 per MWh. There is also an annual, calendar year inflation adjustment for the rates, in which the rates are multiplied by the inflation adjustment factor described above and rounded. The $3 base rate is rounded to the nearest multiple of $0.50, and the $15 PWA rate is rounded to the nearest multiple of $1. As such, using the 2025 inflation adjustment factor of 1.9971, the 2025 base rate and PWA rate (after rounding) are $6 and $30 per MWh of qualifying electricity produced and sold, respectively.

- For projects placed in service after December 31, 2021, the §45 PTC rate calculation is $3 per MWh of qualifying energy, multiplied by the inflation adjustment factor, and rounded to the nearest $0.50. For projects meeting PWA requirements, this product is multiplied by five. There is no separate PWA rate of $15 per MWh of qualifying energy for these projects, and as such, the resulting rate for PWA-compliant projects may have small differences from the PWA rates discussed above, as was the case in 2024. The same technology-specific rate adjustments apply for open-loop biomass, small irrigation power, landfill gas, and trash facilities, so the resulting rate is reduced by one-half. There is no phaseout adjustment for wind projects placed in service after December 31, 2021. The 2025 rate, assuming prevailing wage and apprenticeship compliance, is $30.00 per MWh for wind, closed-loop biomass, geothermal, and solar; and $15.00 per MWh for open-loop biomass, landfill gas, trash, qualified hydropower, and marine and hydrokinetic renewable energy. For qualified hydropower and marine and hydrokinetic renewable energy facilities placed in service after December 31, 2022, the 2024 rate is $15.00 per MWh, assuming prevailing wage and apprenticeship compliance.

- Similar to the ITC case, the Energy Community bonus and Domestic Content bonus add a 10% increase to the applicable rate (Base or PWA-compliant).

Impact on Risk and Due Diligence

For tax credit purchasers, PWA compliance is a major risk factor. If the requirements are not met and the project claimed the enhanced rate, the credit amount can be dramatically reduced (e.g., from 30% to 6% for an ITC), resulting in an "excessive credit transfer". The buyer is liable for this excessive credit amount plus a 20% penalty.

Therefore, PWA compliance heavily influences the due diligence process for transferable tax credit transactions:

- Buyers must ensure sellers maintain extensive records, including payroll records for all laborers and mechanics (including apprentices).

- Documentation must substantiate proper labor classifications, applicable wage rates, and comprehensive apprenticeship records (requests, hours worked, ratios).

- For §48 ITCs, the seller must provide an annual prevailing wage compliance report during the five-year recapture period.

- Buyers should validate if a seller claims an exception, such as verifying the BoC date or the project's output capacity.

- Due to the complexity, Reunion offers a PWA compliance software product to reduce the time and expense of complying with PWA requirements and generate a standardized report for due diligence purposes.

Records and documentation

If PWA requirements are not fulfilled, tax credit buyers who were expecting the full tax credit amount could face a credit disallowance and be subject to underpayment penalties. However, when PWA compliance is well-documented, a careful due diligence process can help buyers get comfortable that the tax credits are properly accounted for.

Prevailing wage records

PWA documentation must include “payroll records for each laborer and mechanic (including each qualified apprentice) employed by the taxpayer, contractor, or subcontractor employed in the construction, alteration, or repair of the qualified facility.”

The guidance also lists further information that the taxpayer “may include” in their records for prevailing wage compliance:

- Identifying information for each laborer and mechanic who worked on the construction, alteration, or repair of the qualified facility, including the name, the last four digits of a social security or tax identification number, address, telephone number, and email address

- The location and type of construction of the qualified facility

- The labor classification(s) the taxpayer applied to each laborer and mechanic for determining the prevailing wage rate and documentation supporting the applicable classification, including the applicable wage determination and copies of executed contracts for construction, alteration, or repair of the qualified facility with any contractor or subcontractor

- The hourly rate(s) of wages paid (including rates of contributions or costs for bona fide fringe benefits or cash equivalents thereof) for each applicable labor classification

- Records to support any contribution irrevocably made on behalf of a laborer or mechanic to a trustee or other third person pursuant to a bona fide fringe benefit program, and the rate of costs that were reasonably anticipated in providing bona fide fringe benefits to laborers and mechanics pursuant to an enforceable commitment to carry out a plan or program described in 40 U.S.C. 3141(2)(B), including records demonstrating that the enforceable commitment was provided in writing to the laborers and mechanics affected

- The total number of hours worked by each laborer and mechanic per pay period.

- The total wages paid for each pay period (including identifying any deductions from wages)

- Records to support wages paid to any qualified apprentices at less than the applicable prevailing wage rates, including records reflecting an individual’s participation in a registered apprenticeship program and the applicable wage rates and apprentice-to-journeyworker ratios prescribed by the registered apprenticeship program

- The amount and timing of any correction and penalty payments and documentation reflecting the calculation of the correction and penalty payments, including records to demonstrate eligibility for the penalty waiver in §1.45-7(c)(6)

- Records to document any failures to pay prevailing wages and the actions taken to prevent, mitigate, or remedy the failure (for example, records demonstrating that the taxpayer (or an independent third party engaged by the taxpayer) regularly reviewed payroll practices, included requirements to pay prevailing wages in contracts with contractors, and posted prevailing wage rates in a prominent place on the job site)

- Records related to any complaints received by the taxpayer, contractor, or subcontractor that the taxpayer, contractor, or subcontractor was paying wages less than the applicable prevailing wage rate for work performed by laborers and mechanics with respect to the qualified facility

Apprenticeship records

For apprentices, the developer should capture:

- Any written requests for the employment of apprentices from registered apprenticeship programs, including any contacts with the DOL’s Office of Apprenticeship or a state apprenticeship agency regarding requests for apprentices from registered apprenticeship programs

- Any agreements entered into with registered apprenticeship programs with respect to the construction, alteration, or repair of the facility

- Documents reflecting the standards and requirements of any registered apprenticeship program, including the applicable ratio requirement prescribed by each registered apprenticeship program from which taxpayers, contractors, or subcontractors employ apprentices

- The total number of labor hours worked with respect to the construction, alteration, or repair of the qualified facility, including and identifying hours worked by each qualified apprentice

- Records reflecting the daily ratio of apprentices to journeyworkers

- Records demonstrating compliance with the Good Faith Effort Exception in §1.45-8(f)(1) (including requests for qualified apprentices, correspondence with registered apprenticeship programs, and denials of requests)

- The amount and timing of any penalty payments and documentation reflecting the calculation of the penalty payments

- Records to document any failures to satisfy the apprenticeship requirements under §45(b)(8) and §1.45-8 and the actions taken to prevent, mitigate, or remedy the failure

- Records related to any complaints received by the taxpayer, contractor, or subcontractor that the taxpayer, contractor, or subcontractor was not satisfying the apprenticeship requirements

Annual prevailing wage compliance report

For §48 ITCs, tax credit sellers must submit an annual prevailing wage compliance report to the IRS during the five-year recapture period. The report should adequately document the payment of prevailing wages with respect to any alteration or repairs of the project.

Tax credit sellers submit the report to the IRS with their tax returns. To ensure compliance with the reporting requirement, tax credit buyers should receive confirmation of the seller’s annual submission.

Compliance

The IRS encourages tax credit sellers to take the following actions to ensure ongoing compliance:

- Regularly reviewing payroll records

- Ensuring that any contracts entered into with contractors require that the contractors and their subcontractors adhere to prevailing wage and apprenticeship requirements

- Regularly reviewing compliance with the prevailing wage and apprenticeship requirements (including the proper worker classifications of laborers and mechanics, the applicable prevailing wage rates, and the percentage of labor hours performed by qualified apprentices)

- Posting information about paying prevailing wages in a prominent and accessible location, or otherwise providing written notice regarding the payment of prevailing wage rates

- Establishing procedures for individuals to report suspected failures to comply with the prevailing wage and apprenticeship requirements without retaliation or adverse action

- Investigating reports of suspected failures to comply with the prevailing wage and apprenticeship requirements

- Contacting the DOL’s Office of Apprenticeship or the relevant state apprenticeship agency for assistance in locating registered apprenticeship programs

Exceptions

Beginning of construction

Projects that began construction before Jan. 29, 2023, are exempt from the prevailing wage and apprenticeship rules, except for credits under §48C and §45Z. To learn more, please refer to the Beginning of construction section.

For the avoidance of doubt, the beginning of the construction test to determine exemption from prevailing wage and apprenticeship requirements is a different test than determining when construction, alteration, or repair of a project began for purposes of starting compliance with prevailing wage rates (as discussed in the When to start paging prevailing wages section).

One megawatt

Projects under §45 and §48 (and their replacements under §45Y and §48E) are exempt from PWA if the maximum net output is less than one megawatt (as measured in alternating current) or the capacity of electrical or equivalent thermal storage is less than one megawatt. The net output will be determined by “nameplate capacity,” defined in 40 CFR 96.202, as the maximum output on a steady-state basis during continuous operation under standard conditions when not restricted by seasonal or other deratings.

In the case of thermal equipment, like geothermal heat pumps and solar process heating, a developer must use the equivalent of 3.4 million British thermal units per hour (mmBTU/hour) to determine maximum capacity. For hydrogen storage and clean hydrogen production facilities, 3.4 mmBTU/hour is equivalent to 10,500 standard cubic feet per hour. Finally, for qualified biogas, developers can convert 3.4 mmBTU/hour into a maximum net volume flow rate of 10,500 standard cubic feet/hour, after converting the gas output into a maximum net volume flow using the appropriate high heat value conversion factors found in an EPA table.

Electrochromic glass, fiber-optic solar, and microgrid controllers are not eligible for the one-megawatt exception because they do not generate electricity or thermal energy.

Remedies

Prevailing wages

If a developer does not meet the PWA requirements, the tax credit does not automatically get reduced to the base rate. A developer can cure any deficiencies and will be deemed to satisfy the PWA requirements if, within 180 days from when the IRS makes a final determination (which occurs on the date the IRS sends a notice to the developer stating that the developer has failed to satisfy the PWA requirements), they:

- Pay back-wages with interest: Pay the affected laborers or mechanics the difference between what they were paid and the amount they were required to have been paid (multiplied by three for intentional disregard), plus interest at the federal short-term rate (as defined in §6621) plus 6%; and

- Pay a penalty: Pay a penalty to the IRS of $5,000 ($10,000 for intentional disregard) for each laborer or mechanic who was not paid at the prevailing wage rate in the year. This penalty applies to each calendar year of the project. If, for example, a laborer is not paid the correct prevailing wage in two calendar years, the penalty is $10,000

The taxpayer can waive the penalty if they make a corrective payment with interest by the last day of the first month after the calendar quarter in which the wage shortfall occurred, and either of two conditions is true:

- The worker was not paid less than the prevailing wage for more than 10% of all pay periods of the calendar year during which the worker was employed on the project

- The shortfall in payment was not greater than 5% of what the worker should have been paid during the year

The penalty is waived if the laborer or mechanic was employed under a “qualifying project labor agreement” and if any correction payment owed to the laborer or mechanic is paid on or before a return is filed claiming an increased credit amount. A qualifying project labor agreement must meet six requirements, which can be found at 26 CFR §1.45-7(c)(6)(ii).

To avoid increased penalties due to intentional disregard, the taxpayer should undertake a quarterly (or more frequent) review of wages paid to mechanics and laborers to ensure that wages not less than the applicable prevailing wage rate were paid.

Apprentices

Apprenticeship cures are unique to the failure that occurred. To cure a failure of a particular requirement, the following processes apply:

- Apprentice labor hours requirement: Any shortfall in apprentice labor hours is calculated (see Labor hours requirement section above and reclassification of apprentices to journeyworkers in the Apprentice ratio requirement below) and multiplied by $50 (or $500 for intentional disregard) to determine the amount of cure payment owed.

- Apprentice ratio requirement: The required apprentice-to-journeyworker ratio is calculated daily (see Ratio requirement section above), and apprentices in excess of the ratio are required to be paid a journeyworker wage. Labor hours from apprentices in excess of the ratio are also accounted for as journeyworker labor hours in the apprentice labor hours requirement above. Any shortfall in prevailing wage payments resulting from this reclassification of apprentices to journeyworkers must be remedied to maintain compliance.

- Apprentice participation hours requirement: If the participation requirement is not met (see Participation requirement section above), the shortfall in participation hours is the total labor hours divided by the number of laborers or mechanics (for the laborers or mechanics that failed to meet the participation requirement). This shortfall in participation hours is then multiplied by $50 (or $500 for intentional disregard) to determine the amount of cure payment owed.

Good-faith effort exception

The apprenticeship requirement can be satisfied if the developer or contractor made a good-faith effort to comply. The developer or contractor must have requested qualified apprentices from a registered apprenticeship program and either:

- The request was denied for reasons other than the developer’s refusal to comply with the program’s standards and requirements

- The apprenticeship program failed to respond within five business days of receiving a request

- The apprentice program provided apprentices, but there were fewer than requested

To satisfy the good faith effort exception, the developer or contractor must make a written request to at least one registered apprenticeship program that has a geographic area of operation that includes the location of the facility, or that can reasonably be expected to provide apprentices to the location of the facility; trains apprentices in the occupation(s) needed by the developer performing construction, alteration, or repair with respect to the facility; and has a usual and customary business practice of entering into agreements with employers for the placement of apprentices in the occupation for which they are training, pursuant to its standards and requirements.

An apprenticeship request must be made at least 45 days before the qualified apprentice is requested to begin work on the facility, so that registered apprenticeship programs have adequate time to plan for the anticipated need. Subsequent requests to the same registered apprenticeship program must be made no later than 14 days before qualified apprentices are requested to begin work on the facility.

If no apprentice program covers the project location, trains apprentices in the occupations needed, and supplies apprentices to employers, then the project is deemed to have made a good-faith effort without the need to file a request for apprentices. In this case, however, developers or contractors must contact the DOL and/or a state apprentice agency to help find apprentices.

A good-faith effort exception can be applied as an exemption from a portion of the apprentice labor hours requirement for a period of 365 days (or 366 during a leap year). The good faith effort exception excuses a developer or contractor from the amount of labor hours that were requested from the applicable apprentice program by applying the requested block of labor hours towards the numerator (apprentice labor hours) of the apprentice labor hours calculation. Developers or contractors must submit a subsequent request within the 365-day (or 366-day) window to continue to satisfy the good-faith exception for an additional block of apprentice labor hours. The annual duration also applies if a developer or contractor is not able to locate a registered apprenticeship program with an area of operation that includes the location of the facility.

Due diligence

Under the IRS regulations, it is the seller’s obligation to maintain and preserve sufficient records demonstrating compliance with PWA requirements. But the liability for non-compliance is on the buyer in the form of an excessive credit transfer.

If the tax credit claims to be exempt from PWA requirements, the tax credit buyer should substantiate the exemption under one of two scenarios:

- Beginning of construction exemption: Validate and substantiate that construction began before January 29, 2023

- One megawatt exemption: Validate the size of the eligible project through an audit of relevant contracts

If the tax credit requires compliance with PWA requirements, the tax credit buyer should validate that proper documentation was collected by the seller and that compliance was substantiated by a third party. At a minimum, the IRS requires “payroll records for each laborer and mechanic (including each qualified apprentice) employed by the taxpayer, contractor, or subcontractor.” The IRS also lists several other items the taxpayer may include in their records for PWA compliance, including nine related to wages and five related to apprentices; the list is available at 26 CFR §1.45-12(c) and (d).

Tax credit buyers should ensure sellers (or a contracted third party) have properly collected, maintained, and reviewed payroll records to ensure that prevailing wages were paid and sufficient apprentice labor was utilized. Tax credit sellers often engage third parties to provide additional analysis with respect to PWA compliance. Furthermore, buyers should also review the covenants, representations, and warranties in contracts with the primary EPC (and potentially with their subcontractors) to validate that all parties have agreed to comply with PWA requirements.

In the case of the §48 ITC, the seller should also provide an annual compliance report to the IRS during the recapture period.

Guidance and resources

Guidance

- November 30, 2022: IRS Notice 2022-61, Prevailing Wage and Apprenticeship Initial Guidance Under §45(b)(6)(B)(ii) and Other Substantially Similar Provisions

- August 30, 2023: Notice of Proposed Rulemaking, Increased Credit or Deduction Amounts for Satisfying Certain Prevailing Wage and Registered Apprenticeship Requirements

- November 17, 2023: Notice of Proposed Rulemaking, Definition of Energy Property and Rules Applicable to the [§48] Energy Credit

- June 24, 2024: Final regulations, Increased Amounts of Credit or Deduction for Satisfying Certain Prevailing Wage and Registered Apprenticeship Requirements

Resources

- The IRS maintains a prevailing wage and apprenticeship requirements FAQ

- The Department of Labor determines and maintains prevailing wages

- To request a wage determination, developers can email iraprevailingwage@dol.gov with project and labor information

- Apprenticeship.gov provides resources for finding qualified apprentices

- Reunion maintains a Reunion PWA Help Center for Reunion PWA customers that includes information about various regulations and instructions for submitting information to the DOL

Frequently Asked Questions about Prevailing Wage & Apprenticeship

- How can developers structure contracts to ensure continuous compliance with prevailing wage requirements across multi-phase projects?

- Ensure that contracts with EPCs (or primary contractors) contain provisions obligating the EPC and all subcontractors to abide by prevailing wage and apprenticeship requirements. Additionally, ensure that the EPC is obligated to provide certified payroll records and other relevant information to the developer (or a third party) such that PWA compliance can be certified.

- What mechanisms exist to verify and document apprenticeship utilization to satisfy the IRA’s PWA requirements?

- Developers (and contractors) should ensure that apprentices are hired from a registered apprentice program (listed on apprenticeship.gov) and that all apprentices have a certificate of registration with the applicable apprenticeship program.

- How do project timelines and change orders affect prevailing wage determinations?

- Wage determinations are “locked in” on the execution date of the construction contract with the EPC for a facility. However, wage determinations must be updated in one of the following situations:

- A new contract for alterations or repairs is executed after the facility is placed in service. In this case, use the wage determinations that are in effect when that alteration/repair contract is signed.

- There is a material contract change to the initial EPC contract. If the EPC contract is amended to substantially add scope or extend the contract period, wage determinations must be reset to the then-current modifications.

- Indefinite-term contracts are not tied to specific work. In this case, wage determinations must be reset each new contract year.

- Wage determinations are “locked in” on the execution date of the construction contract with the EPC for a facility. However, wage determinations must be updated in one of the following situations:

- What are the financial and tax credit implications of partial non-compliance with PWA provisions?

- For the purposes of determining compliance with the PWA requirements for the eligibility of the 5X rate multiplier, there is no partial compliance. Either a project is PWA compliant or it is not. That said, there are cure methods for any shortfall with respect to the PWA compliance requirements, such that projects are able to remedy issues and maintain compliance even if mistakes are uncovered later.

- How can digital compliance systems or third-party verification tools be integrated to simplify PWA tracking and reporting?

- Reunion recommends establishing a PWA tracking method at least two months before the beginning of project construction. This ensures that all contractors are aware of their responsibilities with respect to PWA and reporting. The benefit of ensuring tracking is in place before construction is that all parties maintain real-time visibility into a project’s compliance status and are able to get ahead of any underpayments or non-compliant issues before penalties are incurred.

- How are apprentices hired in rural areas or with specialized trades where registered programs may not exist or provide apprentices in the applicable trade?

- If there is no registered apprentice program that both supplies apprentices in the project location and trains apprentices in the occupations needed, then the project is deemed to have made a good-faith effort with the need to file a request for apprentices. However, the US Department of Labor or a state apprentice agency must be contacted in such cases for help finding apprentices in order to claim the good-faith effort exception.

Reunion

November 18, 2025

Compliance Webinar: The 10 Most Common Prevailing Wage and Apprenticeship Compliance Questions

Representatives from Baker Botts and Clean Energy Counsel, alongside Reunion's compliance experts, demystify the most commonly asked questions surrounding PWA compliance and demonstrate how the Reunion platform provides an audit-ready solution.

For Buyers

With Brent Schoradt from Clean Energy Counsel, LLP and Kathryn McEvilly from Baker Botts

Mastering the complexities of Prevailing Wage and Apprenticeship (PWA) requirements is essential to protecting the full value of a project's tax credits. The financial stakes are significant, and reporting errors can put full tax credit values at risk, jeopardizing financing and project viability.

Recording: The 10 most common prevailing wage and apprenticeship compliance questions

Questions Covered:

Question 1: Supplemental Wage Determinations (06:25)

In what situations should supplemental wage determinations be requested, and once you get a response from the DOL, what should you do with the s supplemental wage determination?

Summary: If a project requires a trade or occupation not listed in the applicable wage determination for the state and county where a project is being constructed, contractors must request an additional wage determination (SF-1444 conformance request). Once the DOL responds to the conformance request, contractors should ensure that laborers performing work under this supplemental wage determination are paid according to the prescribed rates.

Question 2: Delayed Supplemental Wage Determinations (09:04)

What happens if you don't receive a supplemental wage determination before the start of construction?

Summary: If construction starts before the DOL has responded to a conformance request, there is relief to avoid penalties in the case where the initially requested rate was less than the rate in the DOL's final determination: you must pay back wages (the difference between what was paid and the rate defined in the supplemental wage determination) within 30 days of receiving confirmation of the supplemental wage determination from the DOL. As long as these back wages are paid within 30 days of receipt of confirmation from the DOL, you do not have to pay interest along with the back wages.

Question 3: Changes in Supplemental Wage Determinations (11:24)

What happens if your conformance request response comes back from the DOL, and they tell you that you need to pay more than the rate that you indicated in your request?

Summary: If the final supplementary wage determination rate is higher than the rate that you had initially requested, you must pay the difference (back wages) within 30 days. Failure to pay these back wages within the 30-day window subjects the taxpayer to normal cure provisions, including interest and the $5,000 per laborer per year penalty.

Question 4: Exemption from PWA Compliance (14:13)

Are certain activities exempt from PWA compliance, and specifically, what activities are exempt during the alteration and repair period?

Summary: Exemptions exist for projects under 1 MW or those that began construction before January 29, 2023. While regular maintenance is exempt, activities like site clearing and preliminary work are considered "construction" under the Davis-Bacon Act (DBA) definition referenced by PWA, making them subject to PWA compliance.

Question 5: Apprenticeship Requirements (18:52)

How can developers be confident in satisfying the apprentice participation, ratio, labor hours, good faith effort requirements?

Summary: Developers should track compliance against the three apprenticeship requirements: Participation (at least one apprentice must be hired per contractor with four or more laborers performing work on the project), Ratio (daily tracking of the apprentice-to-jouneyworker ratio to ensure that this ratio is compliant with the prescribed ratio of the associated apprenticeship program), and Labor Hours (15% of total labor hours must be worked by apprentices for projects that began construction in 2024 or later).

The Good Faith Effort exception is met if a proper request for apprentices is submitted in writing and denied or not responded to within five business days. Additionally, the Good Faith Effort exception may be claimed if no apprentice program covers the project location, trains apprentices in the occupations needed, and supplies apprentices to employers. In this case, the US Department of Labor or state apprentice agency must be contacted to help find apprentices. The Good Faith Effort exception excuses a contractor from the apprentice participation requirement and from a portion of required apprentice labor hours, depending on how many apprentice hours were requested.

Question 6: Job Sites Across Multiple Counties (34:10)

How should I handle PWA compliance for a single site that spans two different counties?

Summary: You must comply with the prevailing wage and apprenticeship requirements of each county individually. Recommended approaches include paying the higher wage rate across both counties or requesting a single supplemental wage determination applicable to the entire job site.

Question 7: Feedback from Tax Credit Buyers and Insurers (36:20)

What are the most common items that tax credit buyers and insurers find are missing in PWA compliance reports?

Summary: The most common issue is a lack of data from subcontractors, often because the project sponsor lacks direct contractual privity with them. This logistical difficulty leads to incomplete or delayed compliance reports.

Question 8: Making Back Payments (39:23)

If a laborer is underpaid, how long do I have to pay them back? Are there any penalties associated with the underpayment? And how can I make sure that my subcontractors are aware of any wage deficiencies and that they remedy them in a timely manner?

Summary: Underpayments must be corrected by paying back wages plus interest (short-term federal rate + 6%). The penalty of $5,000 per laborer per year is waived if the deficiency is identified and corrected by the end of the month following the calendar quarter in which the underpayment occurred. The Reunion platform provides automated notifications to contractors when underpayments or other non-compliance are identified. This ensures that contractors are made aware of any back pay requirements in a timely manner.

Question 9: Demonstrating Intent to Pay Penalties (47:36)

If I have PWA penalties due and intend to pay them with my tax return, how should I document this intent for purposes of demonstrating my project's PWA compliance?

Summary: To satisfy tax credit investors/buyers, documentation often includes a letter of intent to pay the penalty with a developer's tax return. In some cases, a cash escrow account may be set up to ensure the availability of funds for the penalty payment.

Question 10: Definition of a Qualified Facility Under Section 48E (50:28)

If my project is pursuing Section 48E tax credits, do I need to track PWA compliance on a more granular level than on the project as a whole to comply with the definition of a qualified facility under Section 48E?

Summary: Unlike older credits, Section 48E technically requires establishing PWA compliance (including the 15% apprentice labor hour requirement) at the level of the qualified facility (e.g., an individual inverter block for solar). Because this granular tracking is commercially infeasible, the market is currently revolving around using a reasonable allocation method to establish compliance at the qualified facility level.

Timestamps:

- 00:00-01:14 - Welcome and Technical/Administrative Notes

- 01:14-04:33 - Panelist and Moderator Introductions

- 04:33-06:25 - Reunion Company Overview & PWA Platform

- 06:25-11:24 - Supplemental Wage Determinations

- 11:24-14:13 - Penalties and Curing Wage Deficiencies

- 14:13-18:31 - Exemptions from PWA Compliance

- 18:31-23:41 - Apprenticeship Requirements Deep Dive

- 23:41-34:10 - Tracking Apprenticeship Compliance & Risk Management

- 34:10-37:01 - Compliance for Multi-County Job Sites & Missing Data

- 37:01-47:36 - The Role of Tax Credit Buyers/Insurers & Penalty Details

- 47:36-55:32 - Documentation and Section 48E Qualified Facility Issues

- 55:32- 01:00:45 - Final Audience Q&A and Closing Remarks

Reunion

November 12, 2025

Tax Credit Buyer Webinar: Navigating Carrybacks and Carryforwards in Clean Energy Tax Credit Transactions

Tax and legal leaders from CLA, Orrick, and McDermott discuss how tax credit carryback and carryforward provisions work in practice and what they mean for tax credit purchasers.

For Buyers

With Brandon Hill from CliftonLarsonAllen, Debbie Harrison from McDermott Will & Schulte, and Mark Christy from Orrick, Herrington & Sutcliffe

Clean energy transferable tax credits have created new opportunities for taxpayers to participate in the clean energy transition while offsetting tax liability, but understanding the mechanics of carrybacks and carryforwards is essential to capturing their full benefit.

Recording: Navigating Carrybacks and Carryforwards in Clean Energy Tax Credit Transactions

Insights from the conversation:

1. Carrybacks Create a Four-Year Tax Liability Window

The ability to carry a clean energy tax credit back 3 years and carry forward 22 years is the core mechanism. For a corporate buyer, this potentially aggregates four years of tax liability (the current year plus the three carryback years), making a carryback a great fit for any taxpayers with a trailing federal tax liability. Some examples of strong profiles for a carryback strategy include tax payers with a large, one-time event in a recent tax year or relatively smaller taxpayers looking to aggregate up to four years of liability to make a larger tax credit purchase. The carryback must first be applied to the current tax year, and then carried back to the earliest possible year first, with each year thereafter sequentially. Each tax year is subject to the statutory cap (75% of federal tax liability).

2. Cash Flow is the Primary Strategic Concern

One potential challenge of a carryback is the mismatch between the date the buyer pays for the credit and the date the refund is received from the IRS. Since a carryback claim is effectively filed simultaneously with the current year's tax return (which may be several months after year-end for corporates), there may be a notable lag. To alleviate this burden, tax credit buyers frequently negotiate delayed / split payment structures (or possibly lower upfront purchase prices) with tax credit sellers to improve the overall return on investment.

3. IRS Refund Timing is Variable (But Pays Interest)

Once the carryback claim is filed, the refund processing time is variable. The IRS publishes processing statuses online, which suggest an approximate 90-day timeline to process carryback claims. Notably, the IRS will pay interest on carryback refund claims that have been outstanding for more than 45 days. Subject to a given taxpayer’s internal cost of capital, some buyers have found interest payments to be accretive to the overall transaction ROI. Carryback refund claims under $5 million are not subject to Joint Committee on Taxation (JCT) review, which may also lead to faster processing.

4. Credit Ordering Rules Matter (Form 3800)

Taxpayers who have other general business credits (e.g., low-income housing, work opportunity, etc.) should be mindful of the instructions established in the Form 3800 General Business Credit (”GBC”) ordering rules. These rules dictate the order by which certain GBCs (including energy tax credits) must be applied against the current year's tax liability, and can have downstream impacts on carryback or carryforward mechanics.

Conversation overview:

- Welcome, Introductions, and Agenda Overview

- Mechanics of Carrybacks and Carryforwards: Rules, Caps, and Filing Forms (1139/1120X)

- Documentation, Negotiating Payment Timing, and Managing Cash Flow for Refunds

- Practical Considerations: IRS Refund Timing, Interest Payments, JCT Review, and Audit Risk

- Buyer Profile, Strategy, and Credit Ordering Rules for Carryback Optimization

- Market Update: Supply, Pricing Trends, and Emerging Credits (45Z Clean Fuel and 45U/45Y Nuclear)

- Audience Q&A and Final Closing Remarks

Alex Melehy

October 29, 2025

A Comprehensive Guide to Complying with Beginning of Construction Requirements

Explore updated beginning of construction (BoC) requirements for wind & solar projects. Know eligibility, safe harbors & IRS 2025 guidance for renewable energy tax credits

For Buyers

For Sellers

Defining the beginning of the construction date for a renewable energy project has historically been a thorny task for developers with respect to tax credits qualification. A project’s beginning of construction (BoC) date is widely referenced in the statutes and related Treasury guidance governing clean energy tax credits. Notably, the BoC date determines:

- Eligibility of the project for certain tax credits/bonus credits

- Exemption from prevailing wage and apprenticeship requirements

- Exemption from PFE/FEOC restrictions

Historically, the two ways to establish BoC are by starting physical work of a significant nature, or by proving spend-to-date exceeds 5% of the total project costs (the “Five Percent Safe Harbor”).

Physical work of a significant nature

A taxpayer can establish BoC by starting physical work of a significant nature (within the meaning of section 4 of Notice 2013-29) and thereafter maintaining a continuous program of construction (“Continuous Construction”). Physical work may occur on-site or off-site, performed by either the taxpayer or by another party under a binding written contract. On-site physical work does not include preliminary activities such as planning and design, obtaining permits and licenses, or performing surveys, studies, test drilling, site clearing, or excavation for the purpose of recontouring land (as distinguished from excavation for footings and foundations).

For a wind facility, some examples of on-site physical work include the beginning of the excavation for the foundation, the setting of anchor bolts into the ground, or the pouring of the concrete pads of the foundation. For off-site physical work, the manufacture of components must be done pursuant to a binding written contract, with such components not held in a manufacturer’s inventory.

One of the most common ways to satisfy physical work of a significant nature through off-site means is through physical work on a custom-designed transformer that adjusts the voltage of electricity generated by a project for purposes of transmission and distribution.

Five percent safe harbor

Alternatively, a taxpayer can establish BoC through the Five Percent Safe Harbor by paying or incurring (within the meaning of §1.461-1(a)(1) and (2)) five percent or more of the total cost of the facility and thereafter making continuous efforts towards completion of the facility (“Continuous Efforts”). Only costs properly included in the depreciable basis of the facility are taken into account to determine whether the Five Percent Safe Harbor has been met; the total cost of the facility does not include the cost of land or any property not integral to the facility.

Continuity safe harbor

Given that both physical work of a significant nature and the Five Percent Safe Harbor require continuous progress toward completion once construction has begun via either Continuous Construction or Continuous Efforts (collectively, the “Continuity Requirement”), the IRS also provides a safe harbor (the “Continuity Safe Harbor”) pursuant to which the Continuity Requirement is deemed to be satisfied if a taxpayer places a project in service by the end of a calendar year that is no more than four calendar years after the calendar year during which construction began. For example, a project that begins construction in early 2026 will have until the end of 2030 to be placed in service. Notice 2021-41 extended the four-year window to six years for projects where construction began in 2016, 2017, 2018, or 2019, and to five years for projects where construction began in 2020.

Changes to BoC for solar and wind projects under §45Y and §48E

Under the OBBBA, solar and wind projects are subject to an early phasedown in tax credits; projects seeking §45Y or §48E credits must be placed in service before January 1, 2028, unless the projects started construction before July 5, 2026. As a result, solar and wind developers have been racing to establish BoC in order to secure additional time to complete projects. In connection with the OBBBA, President Trump issued Executive Order 14315, directing the Treasury to issue new and revised beginning of construction guidance within 45 days of the order. On August 15, 2025, the Treasury updated guidance (via Notice 2025-42) for purposes of determining whether a wind or solar project has started construction under §45Y or §48E.

Under Notice 2025-42, solar projects with a maximum net output of greater than 1.5 megawatts and all wind projects must perform physical work of a significant nature to establish the beginning of construction. These projects can no longer utilize the Five Percent Safe Harbor and must also maintain a continuous program of construction, which can be satisfied through the existing Continuity Safe Harbor if the project is placed in service by the end of a calendar year that is no more than four calendar years after the calendar year during which construction began.

One notable language change in the physical work requirement is that under the previous Notice 2013-29, a taxpayer could establish the beginning of construction by “starting” physical work of a significant nature, whereas the new Notice 2025-42 requires that the work be “performed.”

Other than re-stating that “there is no fixed minimum amount of work or monetary or percentage threshold required,” Treasury did not draw clear lines on what is required to meet the standard of performing physical work of a significant nature. Financing and insurance markets will need to determine where they are comfortable drawing the lines.

Certain projects can continue to use the old BoC rules that were in place before Notice 2025-42, and therefore can continue to use the Five Percent Safe Harbor:

- Projects that can establish BoC (using the old BoC rules) before September 2, 2025.