Introducing Reunion’s Market Monitor Quarterly Report

A Q2 2025 review of Reunion's Market Monitor, a market intelligence dashboard built on over 300 verified tax credit transfers.

This is a snapshot of Q2 2025 data. For a real time look at transaction data, access the full dashboard here.

In June, Reunion released Market Monitor, a comprehensive view of transferable tax credit pricing, deal terms, and market dynamics. Based on over 300 transactions and $25B of deal volume, Market Monitor represents a 360-degree view of the clean energy tax credit market. You can watch our release webinar.

Alongside the platform, we are also publishing a quarterly analysis to bring key trends and observations to life.

Key trends

- In the first half of 2025, pricing has softened for 2025 credits relative to last-minute 2024 credits

- Seasonality of tax credit pricing has persisted into 2025

- Pricing dispersion reflects deal- and counterparty-specific nuances

- Premium on Investment Grade Tax Credit Sellers amounts to 1 to 2 cents more per credit

- Increased standardization among key commercial terms

- Buyers of all stripes are in the market

- Nearly 20% of 2024 vintage credits closed in early 2025, driven by fiscal-year filers

- Most Section 48 ITC transactions now include at least one bonus adder

- Domestic content remains limited for Section 45 PTCs

- A growing share of credits, 62% of 2025 ITCs, require PWA compliance

Pricing

Pricing for 2025 credits, relative to 2024 credits, has softened

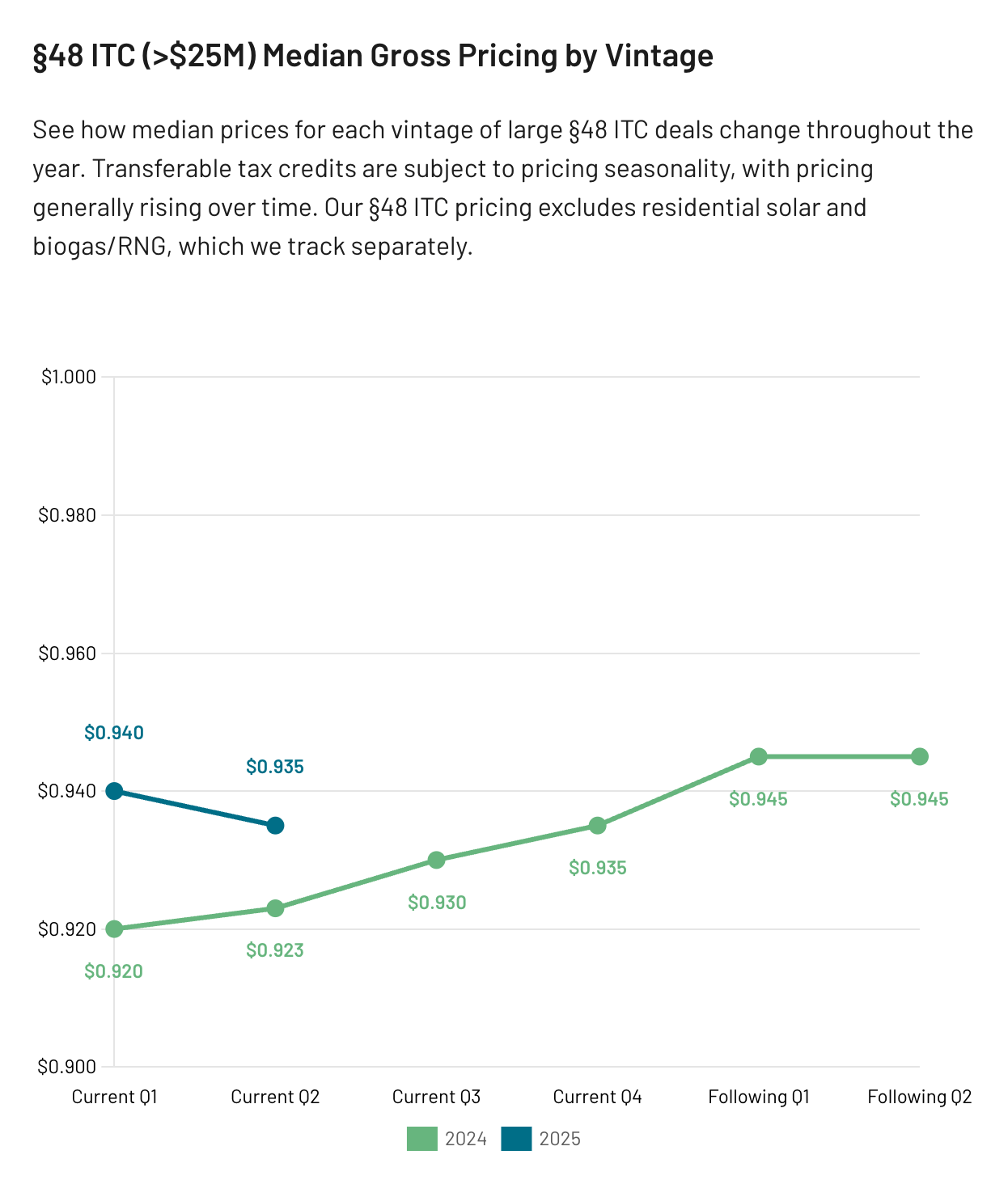

Pricing for 2024 vintage credits generally trended up and remained elevated through Q1 and Q2 of 2025, reflecting a large number of buyers chasing a relatively small number of opportunities (especially for larger Section 48 ITCs). Conversely, 2025 vintage credits saw some softening in price in early 2025.

Seasonality of tax credit pricing has persisted into 2025

The market exhibits annual seasonality driven by supply-demand imbalances. A relatively small share of buyers were ready to purchase credits earlier in the year without knowing their tax liability; this was exacerbated in 2025 due to early-year uncertainty on how tax laws would change as a result of the reconciliation bill (now known as the OBBBA). In general, buyers willing to enter the market earlier in the year may find more deals to choose from and more advantageous terms and pricing.

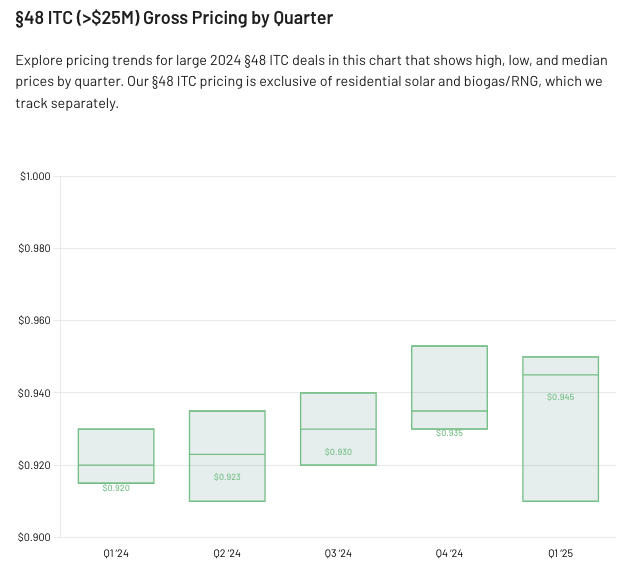

Pricing dispersion reflects deal- and counterparty-specific nuances

Median pricing doesn't tell the whole story. Reunion's data shows pricing dispersion, where factors such as delayed payment timing or indemnities from investment-grade entities can lead to higher prices. Section 48 ITCs tend to have greater dispersion due to a broader mix of technologies and counterparties, while Section 45 PTCs trade in narrower bands.

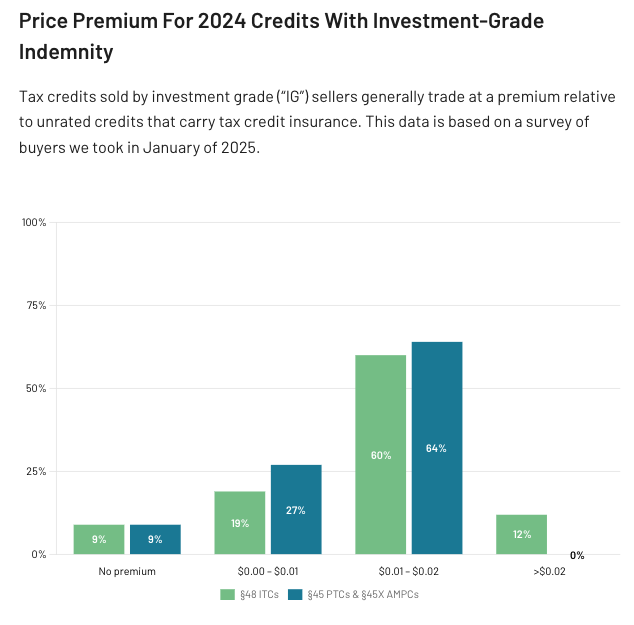

The Premium on Investment Grade Tax Credit Sellers amounts to 1 to 2 cents more per credit

A selection of corporate buyers, many of whom tend to be larger, require an investment-grade counterparty. This translates into higher pricing for tax credits from investment-grade sellers, with tax credits trading for 1 to 2 cents more per credit compared to similar projects that might carry tax credit insurance.

With a finite supply of credits from investment grade sellers. Essentially, these credits are "priced to perfection" due to their scarcity and the perceived lower risk associated with the seller.

Commercial terms

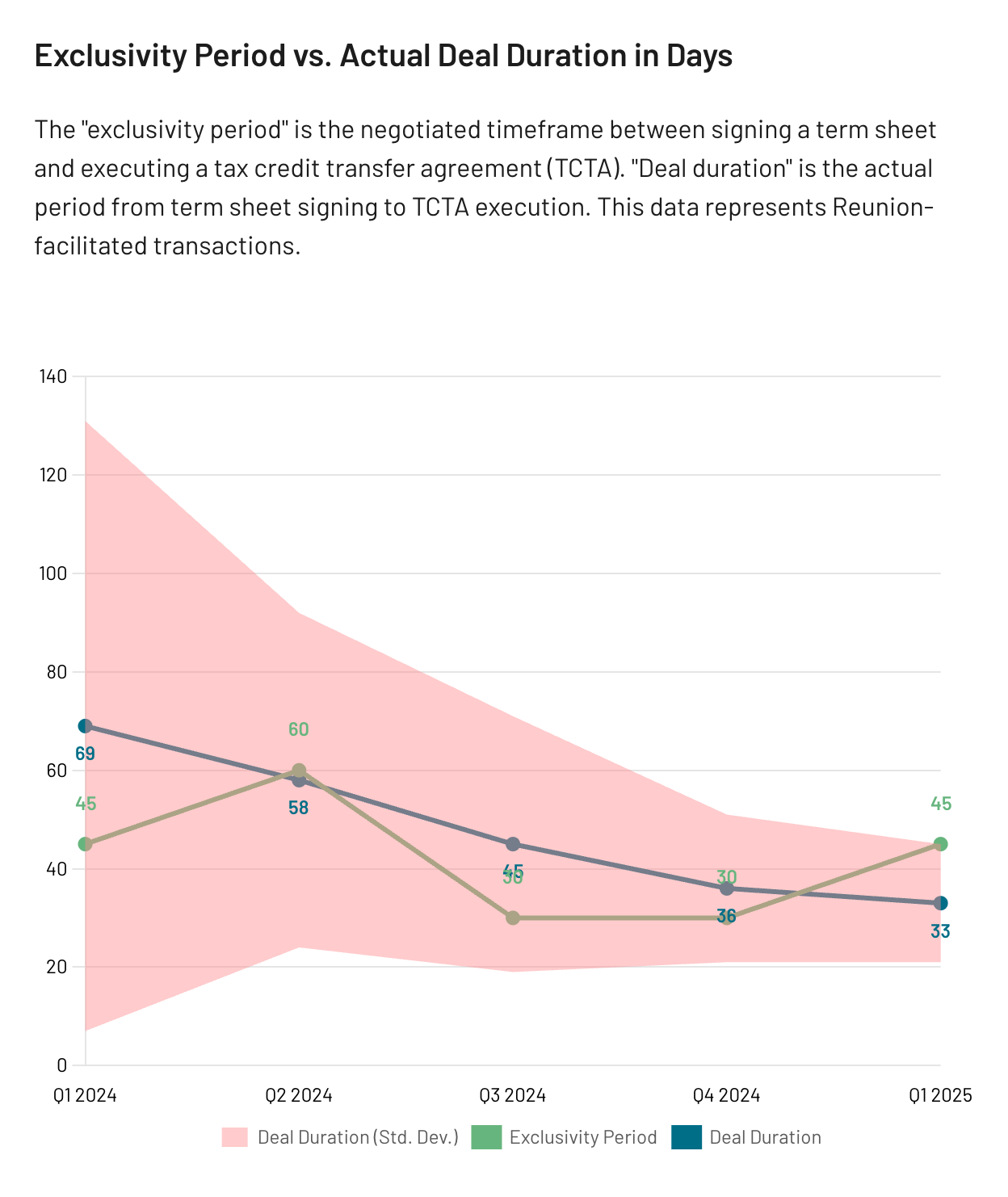

Increased standardization among key commercial terms

Reunion continues to see standardization around key commercial terms — in particular, the buyer fee reimbursement (often $50K-$150K) and exclusivity period (commonly 30-60 days). We believe this is emblematic of a maturing market with increasing efficiency in deal closing.

Markets

Buyers of all stripes are in the market

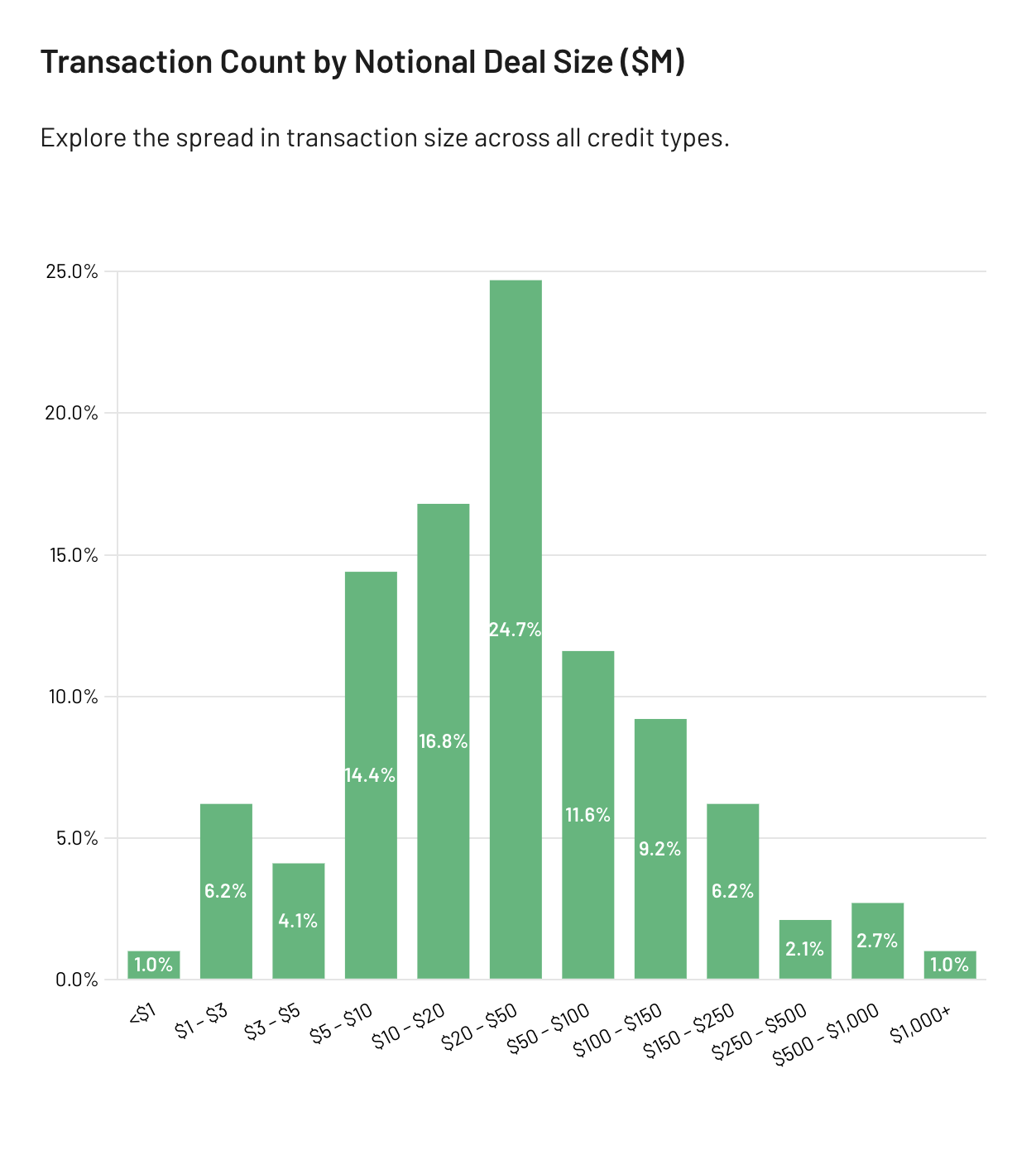

The transferable tax credit market demonstrates wide adoption across various buyer industries and supports a diverse range of deal sizes, from a concentration of $20 to $50M transactions, to a notable volume of $250 million+ deals.

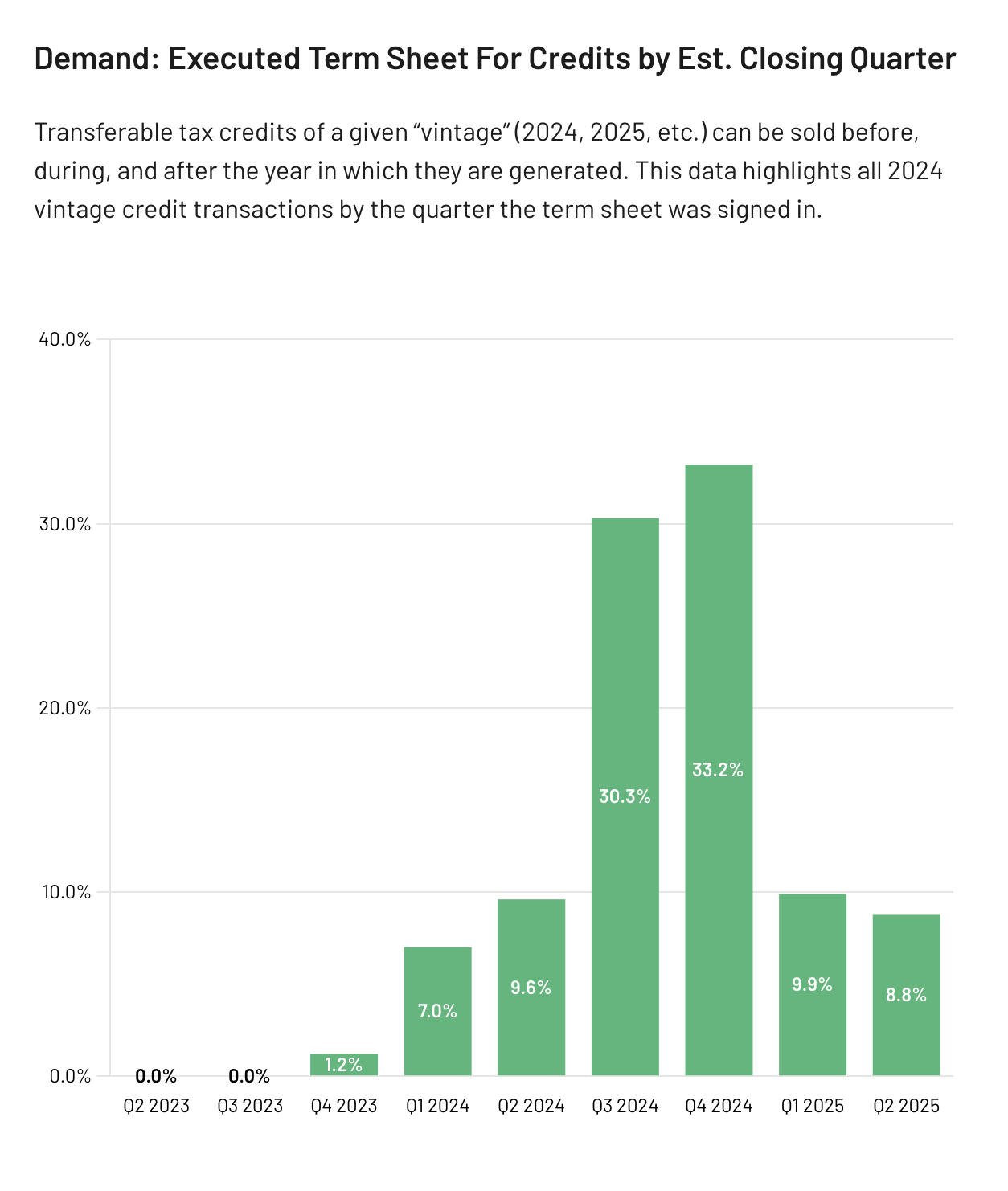

Nearly 20% of 2024 vintage credits closed in early 2025

A significant portion of 2024 vintage credits (nearly 20%) and their associated term sheets closed in early 2025, largely driven by fiscal year-end buyers. This sustained demand, even for prior-year credits, reinforces the importance to buyers of entering the market early.

Credit values

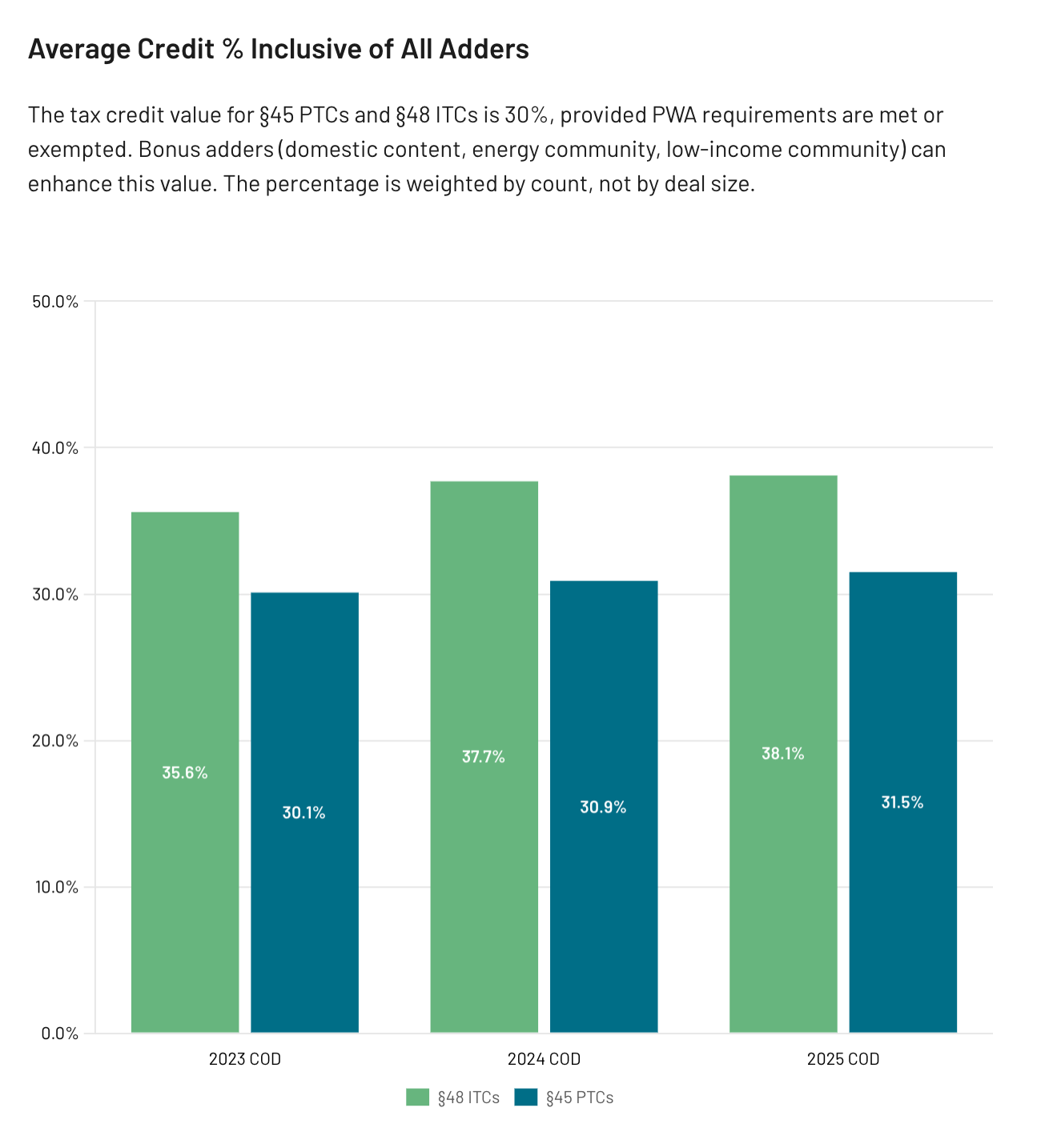

Most Section 48 ITC transactions now include at least one bonus adder

When weighed by dollar value, the average credit value for 2025 Section 48 ITCs is 38.1%. At nearly 40%, the increasing average credit percentage for ITCs implies that most opportunities include at least one bonus credit adder — most commonly energy community, followed by domestic content.

Domestic content remains limited for Section 45 PTCs

Only 2.9% of 2025 Section 45 PTCs — when weighted by dollar value — are claiming the domestic content bonus credit.

Although the elective safe harbor meaningfully increased domestic content adoption for Section 48 ITCs, we have not observed the same flow-through to Section 45 PTCs. This largely stems from “legacy” PTCs that were placed in service before the IRA.

PWA compliance

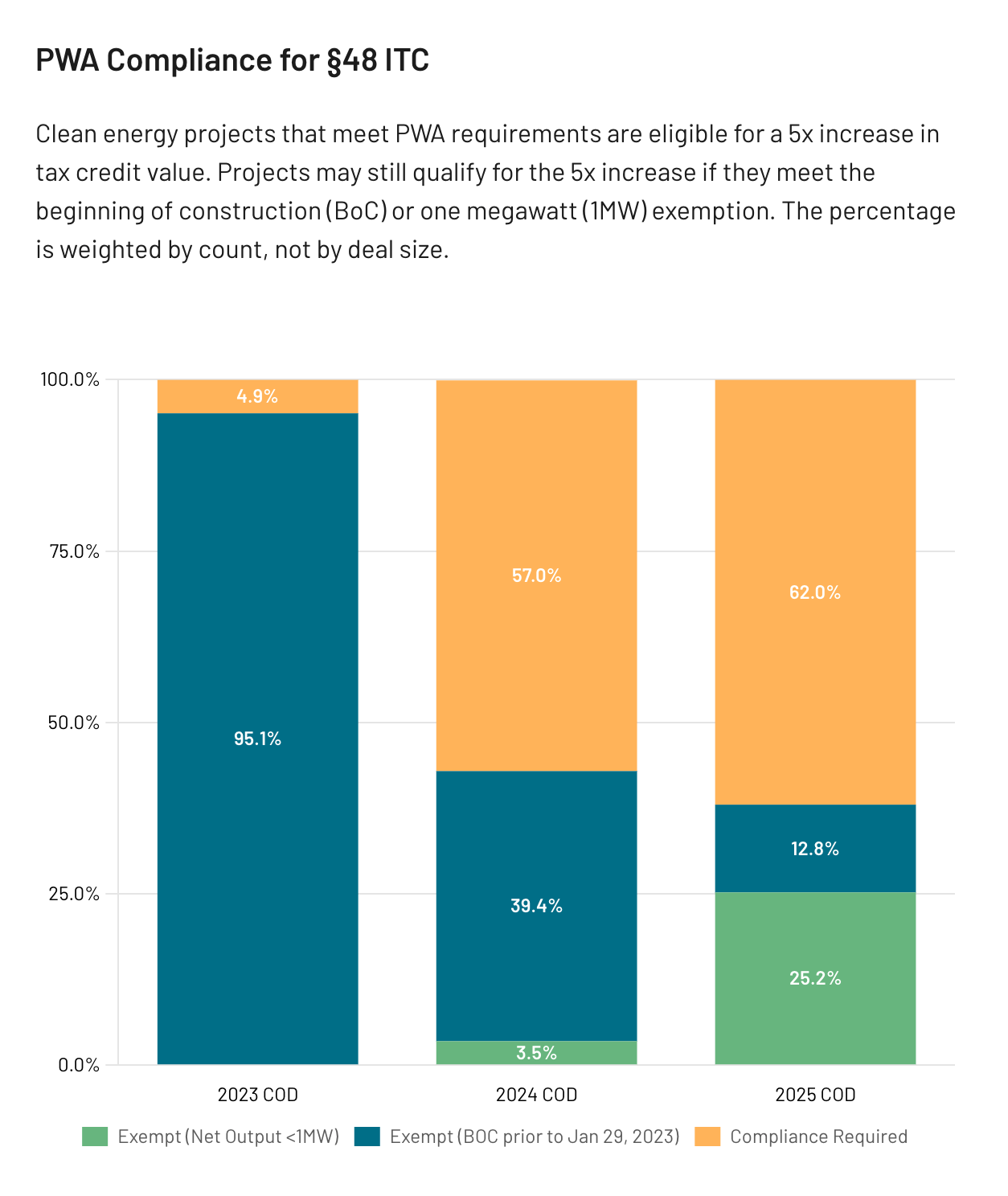

A growing share of credits, 62% of 2025 ITCs, require PWA compliance

PWA compliance is becoming increasingly commonplace for 2025 Section 48 ITCs. However, 25% of 2025 ITCs — Sections 48 and 48E — are exempt from prevailing wage and apprenticeship requirements because of the 1MW exemption. The overwhelming majority of exempt projects are rooftop solar, whether residential (”resi”) or commercial and industrial (”C&I”).

29% of 2025 Section 45 PTCs are PWA exempt — although these credits tend to trade at an “IG-like” premium and clear the market quickly

Approximately 30% of 2025 PTCs by dollar volume are exempt from PWA requirements per the beginning of construction exemption — that is, the projects began construction before January 29, 2023.

.png)

.png)