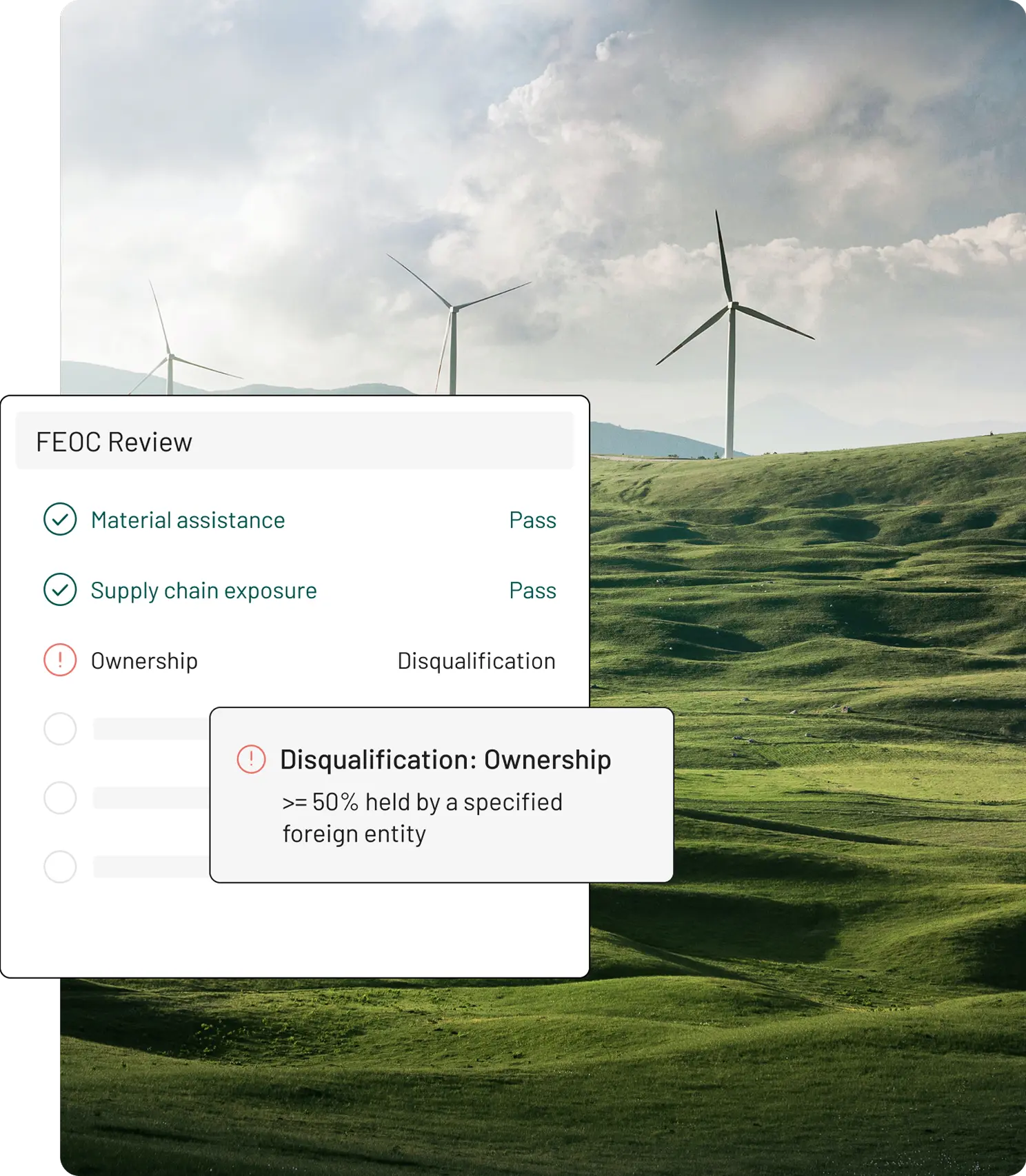

Streamline FEOC Compliance for Tax Credit Eligibility

Reunion FEOC helps renewable energy developers and manufactures navigate FEOC requirements by facilitating fast-tracked ownership checks, supply chain traceability, and risk scoring—delivering audit-ready reports that prove eligibility for a project’s full tax credit value.

Join the WaitlistWhy FEOC Compliance Matters

Projects that fail FEOC compliance face immediate disqualification from tax credit monetization, with clawback risk extending up to 10 years post-placed in service. The stakes are high: a single non-compliant relationship can eliminate hundreds of millions of dollars in tax credit value.

What Is a Foreign Entity of Concern (FEOC)?

Foreign Entity of Concern (FEOC) requirements under the One Big Beautiful Bill Act (OBBBA) are among the most complex hurdles facing clean energy developers today. Projects with ties to Prohibited Foreign Entities (PFEs) risk losing access to clean energy tax credits entirely.

What Triggers FEOC Disqualification?

Material assistance thresholds: The OBBBA restricts developers’ ability to claim §45Y, §45X, and §48E credits if they receive "material assistance" from a PFE.

Effective control triggers: Restrictions to entities that make “applicable payments” to an SFE through a binding contract or licensing agreement.

Board influence: PFEs with director appointment rights or governance influence.

Supply chain exposure: Components, raw materials, or services sourced from PFEs.

Technology licensing: Use of software, IP, or operational systems from PFEs.

The Challenge

Complex global supply chains, opaque ownership structures, and frequently evolving prohibited entity lists make manual compliance reviews error-prone, expensive, and incomplete.

Reunion FEOC: The Practical Path to Compliance

Supply Chain Traceability

Comprehensive analysis of bills of materials across multiple supplier tiers to map sourcing relationships and flag connections to prohibited entities based on origin, contracts, and beneficial ownership.

Ownership Screening

Integrations with corporate registries and government watchlists to screen shareholders and directors against SFE/FIE classifications, monitoring equity changes and governance shifts over time.

Risk Scoring

Quantify FEOC exposure across vendors, cost centers, and geographies with actionable recommendations based on the material assistance thresholds and other disqualification triggers.

Compliance Reporting

Generate IRS- and investor-ready compliance packages with complete audit trails showing supplier, payment, and ownership histories to streamline due diligence for buyers, investors, and insurers.

How It Works

Reunion FEOC brings together supply chain, ownership, and risk data in a single platform to ensure projects meet regulatory standards.

Upload Supplier Data

Upload supplier and ownership information including bills of materials, corporate structures, and financial relationships

Screen for Risks

Run automated traceability and screening checks against Reunion's proprietary PFE database and public watchlists

Review Risk Alerts

Review quantified risk scores and flagged entities with threshold-based alerts for material assistance levels

Export Compliance Reports

Export audit-ready compliance reports with complete documentation trails for tax credit buyers and regulators

Comprehensive, Ongoing Compliance

FEOC compliance isn't a one-time check—prohibited foreign entity designations change frequently, and some projects must maintain documentation for potential audits up to 10 years post-placed in service. Reunion FEOC simplifies oversight and protects against costly disqualification.

Real-time monitoring: Automated alerts when suppliers, ownership structures, or prohibited entity lists change

Threshold tracking: Notifications when project inputs approach disqualifying material assistance levels

Multi-tier supply chain visibility: Track components and relationships across complex global sourcing networks

Continuous watchlist updates: Stay current with evolving PFE designations across government agencies and watchlists

Evidence packages: Demonstrate FEOC compliance across the project lifecycle

Ready to Simplify FEOC Compliance? Start Your Compliance Journey Today.

Don't let FEOC requirements jeopardize your tax credit value. Reunion FEOC delivers the technology and expertise you need to navigate complex compliance requirements and ensures that you get the full tax credit value for your projects.